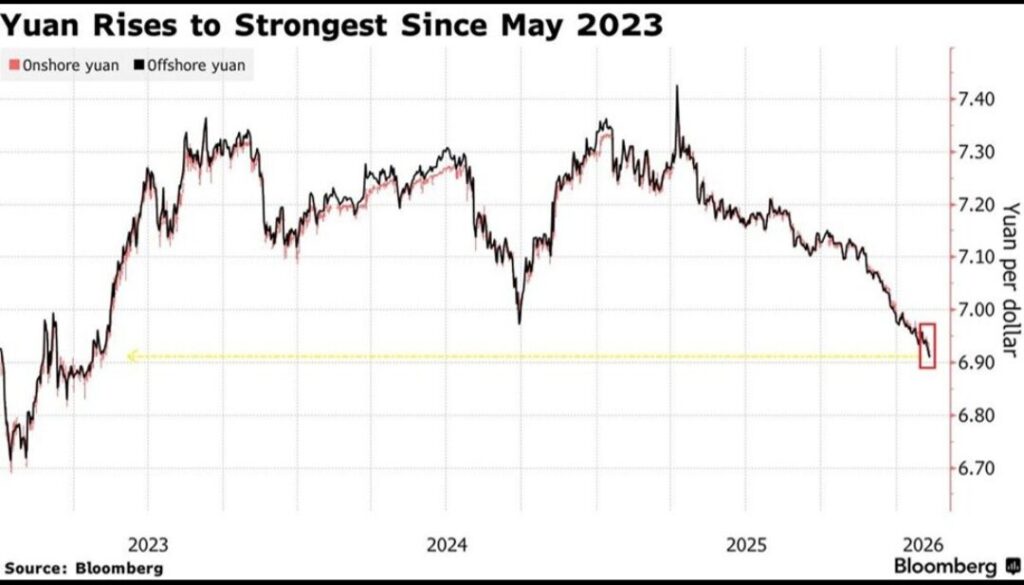

Yuan peaks against the US dollar and it is currently trading at its best since May 2023 at a rate of approximately 6.91 yuan per US dollar. This appreciation in the yuan currency over the USD follows the directive issued by the Chinese regulators to curb the amounts of the US Treasuries held by the financial institutions and this is an action that has been redefining the BRICS yuan stance as seen in the global markets.

The yuan surges to 2023 peaks amid what analysts are terming as a strategic change in the Chinese mode of foreign reserve. The order, that was given to the banks in advance of the last conversation between President Donald Trump and Chinese President Xi Jinping can be viewed as a way that China is changing its Treasury policy to deal with the concentration risks, and other reasons that are to do with the continued US dollar weakness in cross-border trade.

Also Read: BRICS Strategy Faces Strain as India Gains Leverage Over China

BRICS Yuan Currency vs USD Surges Amid US Dollar Weakness & China’s Strategy

Currency Strength Follows Treasury Directive

The yuan hits 2023 high after Bloomberg reported on Monday that Chinese officials had urged banks to curb their purchases of China US bonds, though the advice doesn’t apply to the country’s state holdings. Both onshore and offshore yuan were trading around the 6.91 level per US dollar on Tuesday morning in Hong Kong, and the move has been seen by analysts as part of a broader shift in how China is managing its foreign exchange reserves. The yuan hits 2023 high following this directive, which comes as China’s holdings of US government debt stand at $682.6 billion as of November 2025, making it the third-largest holder after Japan and the United Kingdom.

The yuan is now on track for its seventh consecutive monthly gain, which is the longest streak since 2020-2021, and it’s risen by about 5% since the beginning of 2025. Mark Cranfield, a Markets Live strategist, pointed out that this type of messaging from Chinese authorities is likely circulating quietly in Europe and Asia as well.

Mark Cranfield stated:

“The warning from Chinese authorities to their banks about holding Treasuries is the type of messaging which is likely to be quietly doing the rounds in Europe and Asia. That’s positive for the yuan as global investors diversify into alternate currencies.”

The yuan has also been the third-best-performing currency in Asia since September, and this performance is benefiting from what appears to be increasing US dollar weakness as well as China’s strategic positioning in global markets. The yuan hits 2023 high as market participants adjust to this new dynamic in currency markets.

Market Reactions And Expert Analysis

Chris Weston, who is head of research at Pepperstone Group, noted that the yuan currency vs USD strength appears to be a central factor that’s driving broader US dollar selling flows right now.

Chris Weston said:

“Ongoing strength in the Chinese yuan appears to be a central factor driving broader dollar selling flows, with the PBOC shifting away from a stable exchange rate to one more tolerant of a stronger yuan. Granted, the yuan is fundamentally cheap, but allowing a trending yuan is offering tailwinds to pro-cyclical currencies and China proxies.”

The yuan hit 2023 high levels at a time when economists like Peter Schiff are warning about potential inflationary consequences from China’s Treasury strategy. Schiff has argued that China’s move to limit China US bonds will primarily prompt the Federal Reserve to buy those bonds, which could create inflationary conditions for American consumers. The reduction in China US bonds holdings has sparked debate among financial experts about the long-term implications for both economies.

Peter Schiff wrote on X:

“That will send consumer prices soaring.”

Senator Elizabeth Warren from Massachusetts also raised concerns about the broader implications of countries reducing their Treasury purchases, and she’s been vocal about what this could mean for American families.

Senator Elizabeth Warren stated:

“It would be a huge deal if the world curbs U.S. Treasury purchases, as it would translate to higher rates for car loans and mortgages.”

Global Shift In Reserve Management

The yuan hits 2023 high as part of what appears to be a broader trend of diversification away from US Treasuries. China’s directive comes just weeks after Danish pension fund AkademikerPension, which manages around $25 billion in assets, reportedly planned to offload US Treasuries amid concerns about credit risk tied to US fiscal and political developments. Anders Schelde, who is the Chief Investment Officer of the fund, raised questions about the quality of US government bonds.

Anders Schelde told Bloomberg:

“The US is basically not a good credit and long-term the US government finances are not sustainable.”

Also Read: What Are the Main Goals of BRICS in 2026?

Data compiled by Otavio Costa of Crescat Capital LLC showed that the Federal Reserve has shrunk its holdings of US government debt by about $1.5 trillion since May 2022, and this reduction, when combined with decreased foreign holdings, is being closely monitored by market participants who are concerned about liquidity and yield implications. Foreign governments, which held nearly 40% of US debt back in 2010, have now lowered their holdings to around 15%, according to Geng Ngarmboonanant, a managing director at JPMorgan Chase & Co. and former deputy chief of staff to ex-Treasury Secretary Janet Yellen.