XRP spot ETFs saw $4.05 million in inflows on Feb. 19, 2026, while Bitcoin (BTC) and Ethereum (ETH) spot ETFs saw $165.8 million and $130.1 million in outflows, respectively. Along with XRP, Solana (SOL) spot ETFs also saw inflows of $5.94 million. Let’s discuss what the ETF inflows mean and if the underlying asset will see a price reaction to the capital inflow.

Will XRP’s Price Rally After ETF Inflows?

XRP saw the launch of several spot exchange-traded funds late last year. The asset had quite a bullish year in 2025, seeing the settlement of the SEC vs. Ripple lawsuit and the launch of its first ETF. XRP went on to hit an all-time high of $3.65 in July 2025, hitting a new peak after more than seven years. However, the ETF launch has done little for the underlying asset’s price.

ETFs have become a central part of the crypto ecosystem. Bitcoin (BTC) and Ethereum (ETH) climbed to new all-time highs thanks to increased ETF inflows in 2025. However, XRP is still quite a few steps back. While BTC and ETH saw massive numbers, XRP is still in the lower end. The low inflow numbers could be due to the fact that XRP had its ETF launch after we entered a bearish market trajectory. Things could pick up once market conditions improve.

Also Read: XRP Receives Ambitious & Outrageous Price Prediction of $13 in 3 Months

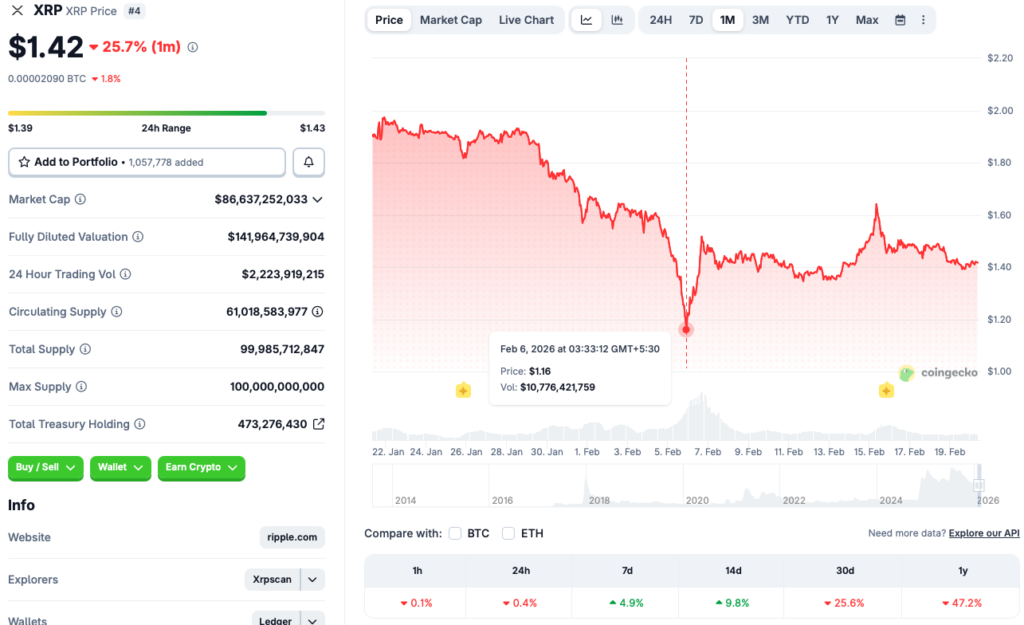

According to CoinGecko data, XRP’s price is currently up by nearly 5% in the weekly charts and almost by 10% on the 14-day charts. However, the asset is down 0.4% in the last 24 hours, 25.6% over the previous month, and 47.2% since February 2025. XRP’s price is following the market-wide downtrend, and could see an upswing once Bitcoin (BTC) displays some positive price action.