During a recent Senate hearing, U.S. Treasury Secretary Scott Bessent predicted a rise in U.S. dollar-pegged stablecoins to a market size of $2 trillion. This development could solidify the U.S. dollar’s influence in global finance, potentially affecting policy and investment strategies.

U.S. Treasury Secretary Scott Bessent highlighted during a Senate hearing that stablecoins pegged to the U.S. dollar are anticipated to expand their market size to $2 trillion. According to Bessent, this growth is aimed at reinforcing the dollar’s global financial system status. Legislative efforts, specifically the GENIUS Act, are anticipated to regulate payment stablecoins comprehensively.

Stablecoins Set to Strengthen Global Dollar Dominance

The growth of stablecoins, particularly those backed by U.S. Treasuries, is expected to enhance both the liquidity and stability of Treasury markets. As the market could see an increase in demand for these assets, the U.S. dollar’s position as a reserve currency would likely be strengthened. This expansion might also create new markets, enhancing the global utilization of the U.S. dollar.

Market participants and experts widely perceive this move as a stabilizing force in cryptocurrency markets. As Bessent explained, the legislation’s backing by U.S. Treasuries would lead to increased demand and utilization of stablecoins. In his words:

“The integration of stablecoins with U.S. Treasuries could lead to an unprecedented demand for government debt, potentially reaching $2 trillion.” – Scott Bessent, U.S. Treasury Secretary

Integration of Stablecoins in U.S. Treasuries Promises Economic Benefits

Did you know? The integration of stablecoins and U.S. Treasuries marks a first in providing large-scale liquidity to digital currency markets, potentially exceeding the prior milestones set by Tether’s capitalization of over $68 billion.

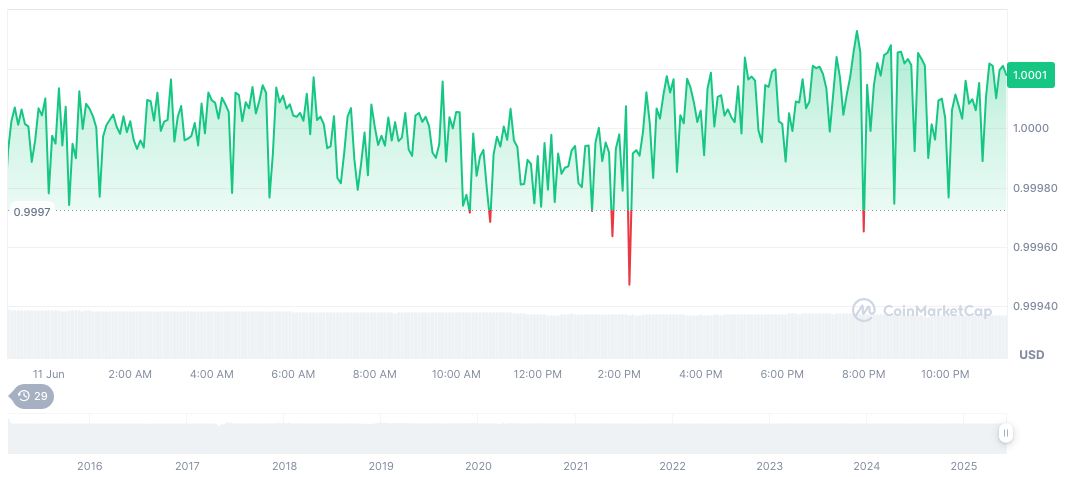

According to CoinMarketCap data, Tether USDt (USDT) is currently priced at $1.00, with a market cap of $154.19 billion and a trading volume of roughly $85.56 billion, reflecting a decrease of 9.99% over the last 24 hours. Recent activity shows price adjustments, with minor shifts observed over 7, 30, and 60 days. As of June 12, 2025, the circulating supply is at 155.19 billion USDT.

The Coincu research team notes the expanding use of stablecoins backed by U.S. Treasuries may present significant economic benefits, enhancing liquidity and financial integration. Historical trends suggest increased blockchain adoption, and expanded regulatory clarity may lead to more stable and reliable financial environments.