Tron announced its merger with SRM Entertainment, intending to rebrand as Tron Inc. and list on Nasdaq. The merger includes leadership changes with Justin Sun as an advisor and significant financial investments.

This event signals a strategic shift with potential impacts on the TRX market and further integration with traditional finance sectors.

Tron-SRM Merger Sparks 300% SRM Stock Surge

Tron’s merger with SRM Entertainment represents a major shift in the blockchain industry, merging cryptocurrency’s decentralized ideology with traditional markets. The move allows Tron to capitalize on SRM Entertainment’s Nasdaq listing by rebranding under Tron Inc. Leadership changes include Justin Sun as adviser and Eric Trump’s expected significant role. Rich Miller, CEO of SRM, stated, “As blockchain technology gains wider adoption globally, Tron has become the industry leader for cross border settlement in U.S. dollar stablecoin. We are excited to invest into the future of the world’s next generation financial infrastructure.”

This merger changes how traditional finance views cryptocurrency, driving potential regulatory interest. Tron’s treasury, backed by $100 million equity investment from a Sun-linked investor, reflects a significant financial realignment. This structure resembles MicroStrategy’s BTC approach with up to $210 million in TRX tokens.

Market reactions were immediate; SRM stock surged by nearly 300%, indicating investor confidence in Tron’s entry into public markets. The merger avoids traditional IPO channels, possibly signaling emerging trends in crypto-finance mergers. Eric Trump’s involvement hints at broader political and regulatory considerations, with no detailed responses from institutional regulators.

TRX Market Impact and Regulatory Perspectives Explored

Did you know? Tron’s strategic use of SRM Entertainment’s Nasdaq listing parallels MicroStrategy’s method of using corporate treasury to bridge equity and digital assets, posing interesting questions on corporate crypto integration.

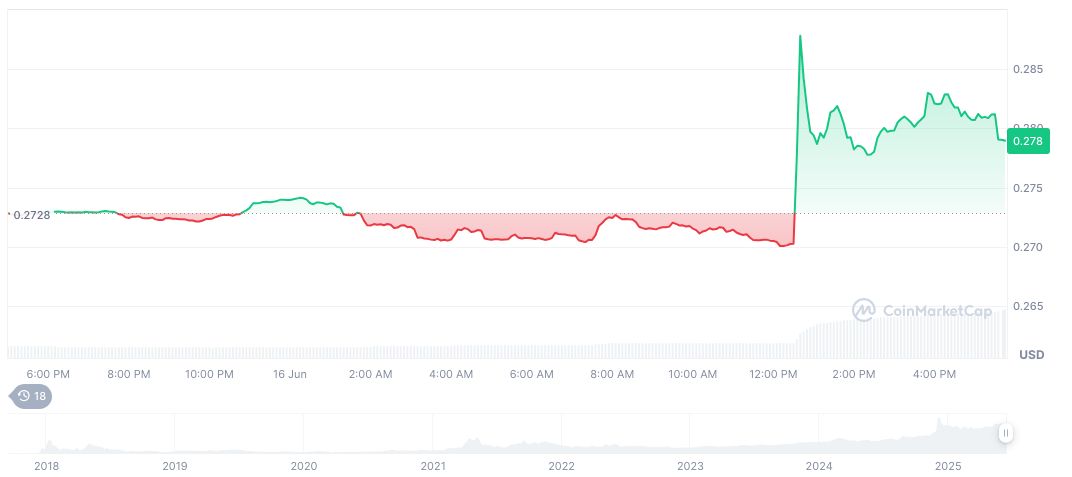

TRON (TRX) exhibits a complex market profile. CoinMarketCap reports TRX at $0.28, with a market cap of $26.53 billion. Recent price movements show a 24-hour increase of 2.79%, while its 24-hour trading volume surged 346.33% to $1.32 billion. Over the past 90 days, TRX saw a 19.31% rise.

Insights from Coincu suggest the merger impacts potentially broaden TRX liquidity and volatility. Enhanced mainstream exposure may stimulate broader market interest but also regulatory challenges. Parallel to MicroStrategy, the use of digital assets as collateral introduces new institutional strategies, balancing emerging regulatory frameworks and technological advancements.