Former Vice Chairman of China’s Securities Regulatory Commission, Li Jiange, discussed the US’s strategic shift towards a digital dollar while outlining its financial and geopolitical impacts.

Li Jiange’s insights on the digital dollar highlight the US’s strategic move to maintain financial dominance amid the evolving global currency landscape.

US Digital Dollar Aims to Reinstate Financial Dominance

Li Jiange’s analysis, conveyed through Caixin.com, highlights the four stages of US dollar anchors, evolving from gold to a potential digital dollar. He indicates this shift aims to reinstate US financial dominance. Li stresses the need for China to accelerate RMB internationalization and digital advancements to counterbalance the digital dollar’s implications. Insights underline a strategic framework, with the US aligning digital currency regulations with national interests.

The potential incorporation of digital assets into regulatory frameworks reflects a strategic consolidation, embracing the fast-paced growth in digital currencies while ensuring compliance. Li’s emphasis on regulatory adaptation includes a comprehensive oversight scheme aligning with US interests.

“The current overall construction idea of the US digital dollar system is to incorporate the wildly growing digital currency ecology in the past into the compliance supervision system to ensure that the development of the digital currency industry is in line with the national interests of the United States.”

Market Uncertainty as Digital Dollar Plans Emerge

Did you know? Past transitions, like the petrodollar, significantly reshaped geopolitical landscapes, maintaining USD’s global demand. The digital dollar era may similarly redefine international finance dynamics.

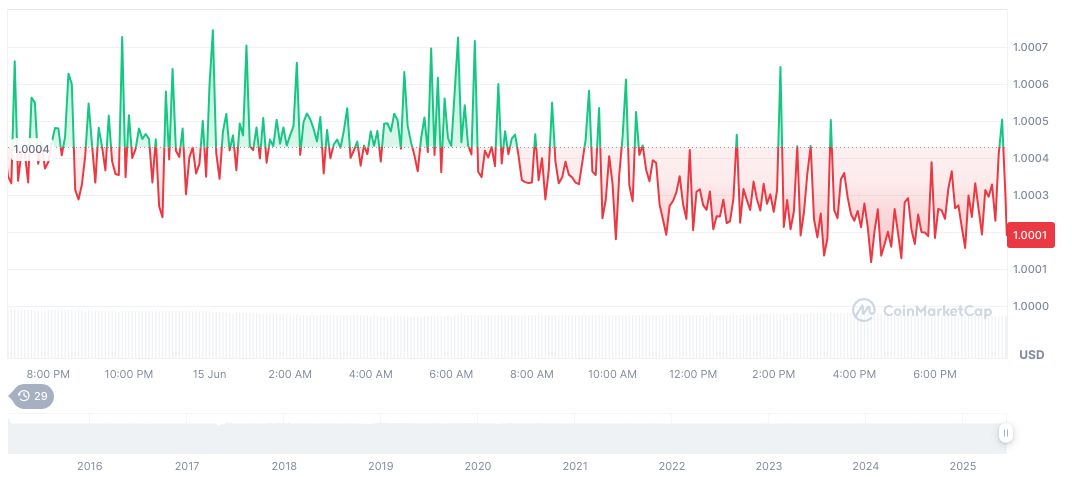

Based on CoinMarketCap, Tether USDt (USDT) remains stable, priced at $1.00 with a dominance of 4.71% in the market. Its 24-hour volume reached formatNumber(51819468217, 2), showing subtle price shifts with a 0.03% decrease in 24-hours and a 0.05% decline over the last 7 days.

Coincu research team foresees that digital dollar initiatives could amplify regulatory compliance frameworks, impacting cryptocurrency ecosystems. Historical trends in currency evolution suggest potential technological advancements alongside regulatory developments as critical outcomes of this shift.