Ubyx, a stablecoin startup founded by former Citigroup executive Tony McLaughlin, has raised $10 million in a seed funding round led by Galaxy Ventures. The funding aims to develop a global stablecoin acceptance network.

The new network is intended to connect stablecoin issuers with banks and fintech companies, addressing payment interoperability issues. This positions Ubyx as a significant player in creating a Visa or Mastercard-like system for stablecoins.

Industry Anticipates Technological Integration and Financial Growth

Ubyx’s funding has garnered support from notable investors such as Galaxy Ventures, Founders Fund, Coinbase Ventures, Paxos, and VanEck. The company’s mission focuses on building a global stablecoin acceptance network that supports multiple blockchains, including Solana, Base, and XRP Ledger. The network, set to launch by the year’s end, aims to facilitate the circulation of stablecoins across different platforms. The network’s compatibility with central bank digital currencies broadens its potential reach.

Immediate implications include the company’s enhanced financial position, enabling it to progress in its mission. The involvement of prominent venture firms underscores institutional confidence in Ubyx’s vision. Analysts predict increased collaboration with banks and fintechs as Ubyx moves closer to solving stablecoin interoperability challenges.

Market reactions to Ubyx’s announcement have been cautiously optimistic due to past challenges in merging stablecoins with traditional financial systems. Industry stakeholders like Tony McLaughlin have expressed limited statements publicly, emphasizing the project’s innovative scope. Observing market participants are eagerly anticipating its progress, with potential ripple effects on related cryptocurrencies.

Efforts to merge stablecoins with established financial systems have historically led to increased stability and legitimacy, akin to Circle’s partnership with Visa.

Historical Context, Price Data, and Expert Analysis

Did you know? The Pax Dollar (USDP) maintains a stable peg to the USD, which is crucial for stablecoin functionality.

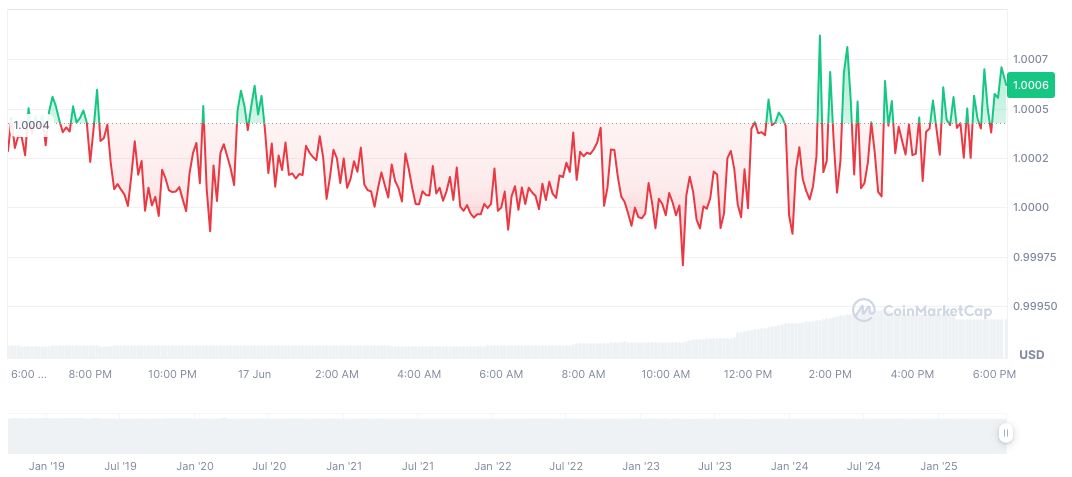

The Pax Dollar (USDP), with a stable peg to the USD, has a market cap of approximately $73.27 million and trades around $1.00. Recently, its 24-hour volume surged by 197.84%, reflecting a change interest in the stablecoin market. These metrics, sourced from CoinMarketCap, indicate mild price stability in the past weeks.

Insights from Coincu suggest potential technological shifts as Ubyx integrates with existing payment infrastructure. The emphasis on interoperability may also pave the way for regulatory dialogues, fostering increased transparency and trust. Observers note the technological implications for future financial cross-chain solutions.