22h22 ▪

3

min read ▪ by

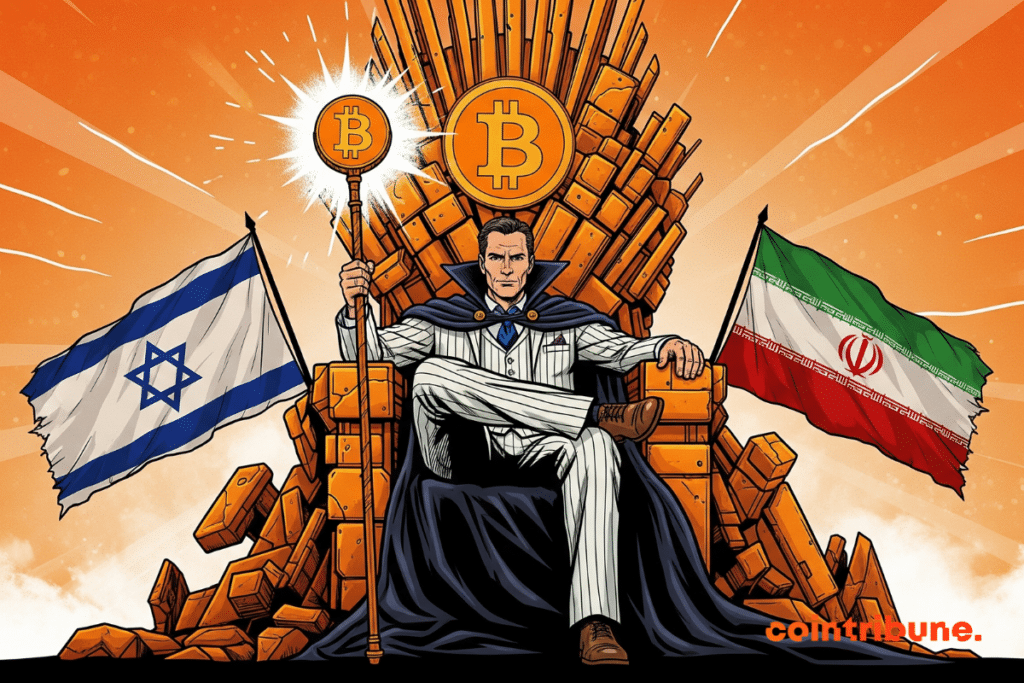

As geopolitical tensions intensify in the Middle East, Michael Saylor and his company Strategy are doubling down aggressively in the bitcoin market. The firm has just revealed a new massive purchase of 10,100 BTC for an amount of 1 billion dollars.

In Brief

Strategy purchased 10,100 BTC for $1B, taking advantage of the drop due to geopolitical tensions.

The launch of STRD on Nasdaq aims to raise $250M to buy more bitcoin.

Strategy strengthens its bet on bitcoin at the market bottom

Amid the escalating conflict between Israel and Iran, the BTC price dropped below 104,000 $. A bargain that Michael Saylor did not miss! The company Strategy has indeed just purchased bitcoins at an average price of 104,080 $.

This acquisition coincides with new strikes on Iranian nuclear sites. It brings the total held by Strategy to 592,100 BTC, purchased for 41.8 billion dollars. This represents an average price of 70,666 $ per unit.

These moves come as Strategy has just launched STRD. This is its third preferred share backed by bitcoin, listed on Nasdaq. Objective: to raise an additional 250 million dollars to further strengthen its positions.

A rising bitcoin yield, but criticisms emerge

Thanks to this latest acquisition, Strategy’s BTC yield since the beginning of the year climbs to 19.1% (up from 17.1% previously). The company now targets a 25% yield for 2025, after raising its initial 15% goal.

However, this frantic race towards bitcoin is not without criticism. According to Matthew Sigel (from VanEck), for example, continuous issuance of shares can dilute rather than create value if it approaches the market capitalization too closely.

The same warning comes from Standard Chartered, which points to the crypto market volatility as a risk for companies too exposed to BTC.

For his part, Michael Saylor remains confident. He also supports other players in the sector, notably praising Metaplanet which has just crossed 10,000 BTC.

As crypto experts fear a regional escalation, bitcoin seems to be becoming a strategic safe haven for companies like Strategy. However, caution remains necessary amid the prevailing euphoria.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

My name is Ariela, and I am 31 years old. I have been working in the field of web writing for 7 years now. I only discovered trading and cryptocurrency a few years ago, but it is a universe that greatly interests me. The topics covered on the platform allow me to learn more. A singer in my spare time, I also cultivate a great passion for music and reading (and animals!)

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.