Bitcoin’s treasury merger activity has reached unprecedented levels as entrepreneur Anthony Pompliano announced a $1 billion deal to create ProCap Financial. This institutional crypto adoption milestone involves merging ProCap BTC with Columbus Circle Capital I, and it represents the largest Bitcoin investment strategy fundraising in bitcoin treasury history. The crypto treasury management company secured $500 million in equity and also $250 million in convertible notes for this groundbreaking $1 billion crypto deal.

Also Read: Metaplanet’s $5 Billion Bitcoin Bet Surpasses Coinbase Holdings

Bitcoin Treasury Merger Sparks Institutional Crypto Adoption Boom

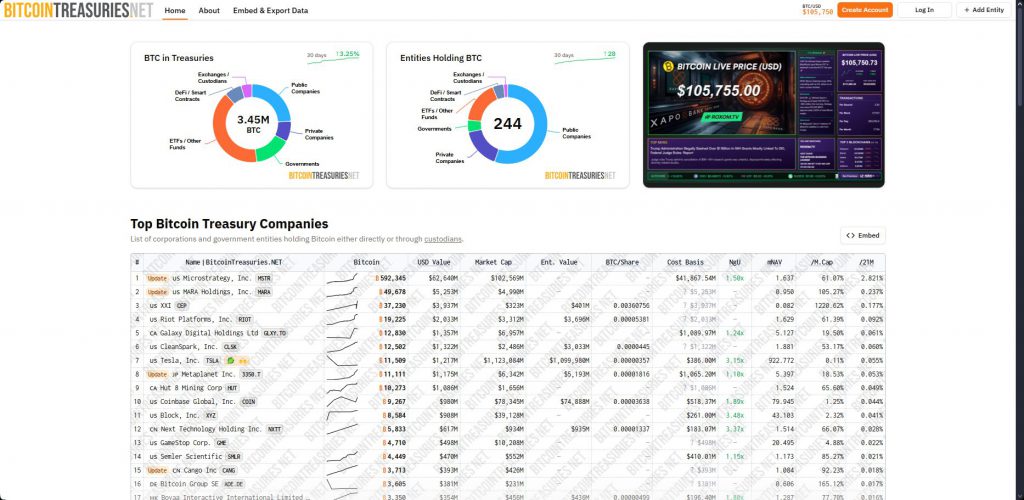

The Bitcoin treasury merger follows MicroStrategy’s successful model, which holds over $63 billion in bitcoin right now. This institutional crypto adoption trend demonstrates how companies are implementing Bitcoin investment strategy approaches to diversify cash reserves and also hedge against inflation concerns that continue to persist.

Pompliano stated:

“The legacy financial system is being disrupted by bitcoin right before our eyes.”

Today I am announcing a $1 BILLION merger to create ProCap Financial, a bitcoin-native financial services.

The company will be a publicly traded entity on Nasdaq at the conclusion of the proposed business combination between my private company ProCap BTC, LLC and Columbus Circle…

— Anthony Pompliano 🌪 (@APompliano) June 23, 2025

Revolutionary Revenue Generation Model

As opposed to other traditional bitcoin treasury companies, ProCap Financial will use its bitcoin holdings to generate profits in the form of lending, derivatives, and financial services as well. The crypto treasury management model is a valuable consideration in that it manages the challenge of market volatility by generating opportunities to generate multiple revenue streams that are not merely due to an appreciation in the value of bitcoin.

Pompliano had this to say:

“Our objective is to develop a platform that will not only acquire bitcoin for our balance sheet, but will also implement risk-mitigated solutions to generate sustainable revenue and profits from our bitcoin holdings.”

Major Institutional Backing

The $1 billion crypto deal attracted significant institutional support, including commitments from Citadel, Susquehanna, Jane Street, and also Magnetar. Crypto-focused firms such as Off the Chain Capital, Pantera, Coinfund, Parafi, Blockchain.com, and FalconX also participated in this bitcoin treasury merger, signaling strong institutional crypto adoption confidence at the time of writing.

Strategic Market Timing

This Bitcoin investment strategy emerges as President Trump seeks cryptocurrency policy reforms, including establishing a strategic bitcoin reserve. The timing supports growing crypto treasury management acceptance among traditional financial institutions, and it addresses previous regulatory uncertainty concerns that have been persistent.

Also Read: Bitcoin, ETH, XRP & SOL Soar on Israel-Iran Ceasefire and Fed Rate Cuts

The bitcoin treasury merger could accelerate similar deals, with ProCap Financial’s active management model demonstrating sustainable revenue generation from bitcoin holdings. This institutional crypto adoption milestone may encourage more corporations to explore Bitcoin investment strategy options, particularly as inflation concerns persist and continue to influence decision-making.

This one billion dollar crypto transaction is an upward movement towards the wider acceptance of crypto treasury management procedures and it possibly establishes new principles in bitcoin treasury merger transactions in the current cryptocurrency market today.