As of June 8, 2025, Hyperliquid’s total value locked has surpassed $33.86 billion, primarily involving USDC and USDT.

This increase reflects Hyperliquid’s strategic positioning as a decentralized finance platform without reliance on traditional venture capital investment approaches.

Hyperliquid’s Remarkable Achievements

Hyperliquid, founded by Jeff Yan, has achieved a substantial milestone in the DeFi sector by reaching a total value locked of $33.86 billion. This growth was fueled by the platform’s focus on USDC and USDT for its trading operations. Yan, a former market maker at Hudson River Trading, has guided the project with a community-first approach, avoiding traditional venture capital investments.

The platform, over the past 24 hours, generated an annualized fee of $878 million, showcasing significant trading activity. Hyperliquid distinguishes itself by operating without VC funding, reinforcing its decentralized narrative supporting transparent and fair access to liquidity.

Community and market reactions remain focused on the unique position Hyperliquid holds, with users and developers engaging actively through official channels. Jeff Yan’s commitment to user-driven development emphasizes the platform’s ongoing efforts to align DeFi solutions with Web2 user expectations.

USDC’s Role in Hyperliquid’s Trading Success

Did you know? During the 2021 DeFi summer, protocols like dYdX witnessed similar TVL surges following the launch of perpetual trading and Layer 2 advancements.

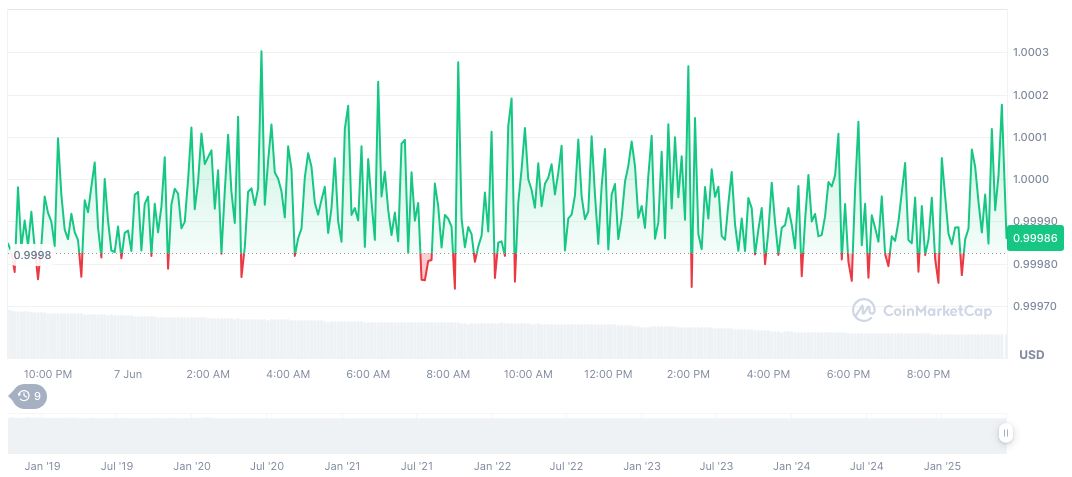

According to CoinMarketCap, USDC currently holds a price of $1.00, with a market cap of $61.08 billion, while observing a 1.26% decrease over 24 hours. Among stablecoins, USDC remains central, partly underpinning Hyperliquid’s robust trading landscape with reliable collateral backing.

Insights from Coincu suggest Hyperliquid’s reliance on a non-traditional funding model may lead to further innovation in decentralized finance structures. Jeff Yan, CEO, Hyperliquid, remarked, “We believe in building protocols that enable transparent, fair access to liquidity for everyone. Our approach is driven by direct engagement with our community and users.”