Hong Kong’s Financial Secretary, Paul Chan Mo-po, announced that the city’s new Stablecoin Ordinance will take effect on August 1, marking a pivotal regulatory move in digital asset management.

The ordinance positions Hong Kong as a leader in stablecoin regulation, potentially enhancing the region’s global financial influence and offering a template for international digital asset governance.

Hong Kong’s Strategic Move in Stablecoin Regulation

The Stablecoin Ordinance, passed by the Legislative Council, establishes a regulated framework for fiat-referenced stablecoins in Hong Kong. Paul Chan Mo-po emphasized its aim to provide a new paradigm for the stablecoin market and to drive innovation in the regional financial sector.

The ordinance permits licensed issuers to utilize a variety of fiat currencies as stablecoin pegs, increasing the variety and cross-border utility of stablecoins in Hong Kong. This adaptability is seen as a way to attract global institutions and enhance market competitiveness.

Daniel Tse, Managing Director, Futu Securities International, “Stablecoins are a promising avenue for growth and innovation in our brokerage industry. We’ve seen a surge in stablecoin-linked investments from our clients, and we envision new opportunities in trading tokenized assets.”

Reactions from financial industry leaders highlight the significance of the ordinance. According to Paul Chan, Hong Kong will also release a “second policy statement” integrating digital asset innovation with financial services, indicating continued regulatory support and expansion plans.

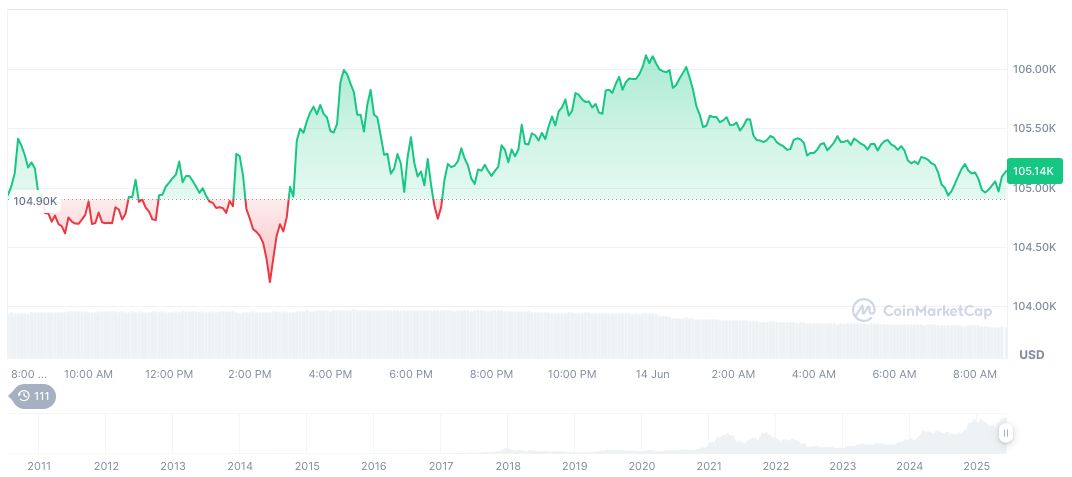

Bitcoin Surges 25% in 90 Days; Expert Opinions

Did you know? Closing the gap between financial regulations and digital assets, Hong Kong’s regulated framework for stablecoins is a first of its kind in Asia, offering new avenues for compliance and innovation.

As of June 15, 2025, Bitcoin’s current price is $105,296.38 according to CoinMarketCap. The cryptocurrency’s market cap stands at $2.09 trillion with a circulating supply of 19,878,000 BTC. Over the past 60 and 90 days, Bitcoin has seen a price increase of 25.47% and 26.05%, respectively.

Insights from the Coincu research team suggest Hong Kong’s proactive stance could stimulate financial innovation and cross-border stablecoin transactions. This regulatory model may influence broader trends in global digital finance.