Fetch.ai CEO Humayun Sheikh revealed the Fetch Foundation’s intention to initiate a $50 million FET token buyback plan. This move is set to be supported by market makers across multiple exchanges. The announcement is significant as it signals confidence from Fetch.ai in its token valuation, potentially stabilizing market volatility and influencing investor perceptions.

Humayun Sheikh announced the Fetch Foundation’s $50 million FET buyback plan. Market reactions were immediate as stakeholders analyzed the potential impacts. While some view the move optimistically, others express cautious optimism amid a broader bearish market sentiment.

$50 Million FET Buyback Announced by Fetch.ai Leadership

The FET token is perceived as undervalued, according to Fetch.ai’s leadership. Sheikh’s assertion that its practicality has improved due to increased ASI1 use marks a strategic pivot for Fetch.ai. This could serve to further integrate AI capabilities within blockchain technology.

Community and industry reactions highlight a mix of optimism and skepticism. The exact influence of this buyback on FET’s valuation remains speculative until its execution is observed in the markets. Nevertheless, market watchers remain attentive to potential shifts in liquidity and trading volumes. As Humayun Sheikh, CEO and Founder of Fetch.ai, noted, “Past events involving significant token repurchase plans have typically aimed to stabilize or increase token value.”

Community and industry reactions highlight a mix of optimism and skepticism. The exact influence of this buyback on FET’s valuation remains speculative until its execution is observed in the markets. Nevertheless, market watchers remain attentive to potential shifts in liquidity and trading volumes. As Humayun Sheikh, CEO and Founder of Fetch.ai, noted, “Past events involving significant token repurchase plans have typically aimed to stabilize or increase token value.”

Historical Context and Market Impact of Token Buybacks

Did you know? The concept of token buybacks has historically been used to reduce supply and potentially increase value, similar to stock buyback strategies in traditional markets.

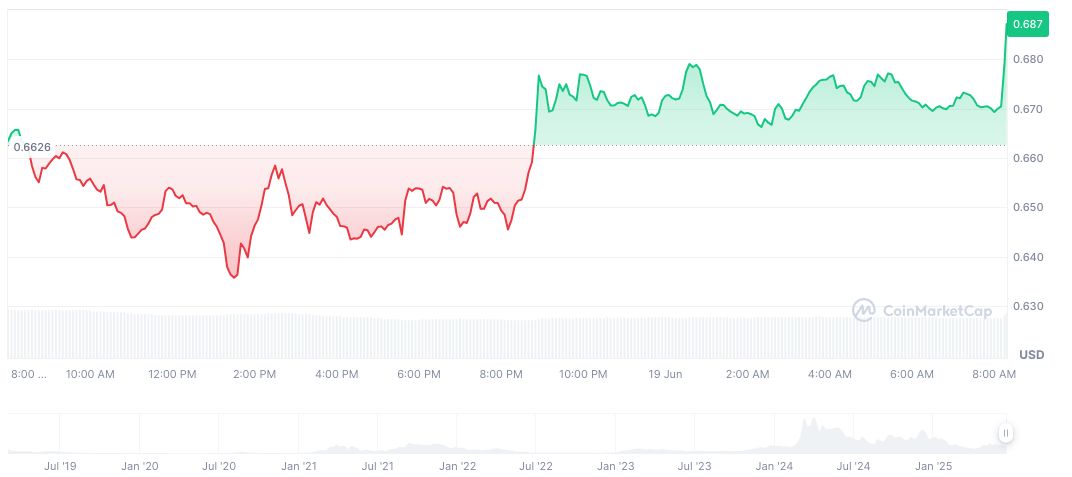

Fetch.ai’s FET token now stands at $0.68 with a market cap of $1.63 billion according to CoinMarketCap. Over 90 days, the token achieved a 31.28% price increase, marked by a circumspect growth impeded by speculative doubts. Trading volume decreased by 10.02%, a reflection of shifting dynamics.

The Coincu research team sees these market moves as pivotal, potentially ushering in increased confidence for investors amid uncertain economic climates. Although future regulatory landscapes pose risks, the technological integration through ASI1 may offer Fetch.ai a competitive edge in decentralized AI advancements.