The U.S. Federal Reserve has kept its benchmark interest rate unchanged at 4.25%–4.50% during a recent meeting. This decision aligns with market expectations as it represents the fourth consecutive meeting without a rate change. The move aligns with previous announcements prioritizing inflation control and data-driven policy.

This rate hold is significant because it sends a signal of stability in monetary policy, potentially influencing economic and crypto markets. Although no immediate impact on cryptocurrencies has been noted, the anticipation of two rate cuts in 2025 may guide future investor actions.

Federal Reserve Rate Stability and Crypto Market Signals

Federal Reserve’s decision to maintain its current rate range aligns with efforts to ensure monetary stability amidst ongoing inflation concerns. This is consistent with Chair Jerome Powell’s previous press conference statements:

The market has largely anticipated this rate hold due to previews from the Fed’s dot plot released earlier. The projection for two rate cuts in 2025 remains unchanged, reflecting cautious optimism from the Fed’s perspective.

Community and leadership reactions are still sparse, with key figures from the crypto and financial sectors yet to comment directly on this decision. However, Vitalik Buterin, Co-founder of Ethereum, has noted, “Fed rate decisions matter for systemic liquidity, but sustainable crypto growth follows real user demand and protocol innovation.” Market watchers anticipate that crypto leaders and developers will provide insights soon, aligning historic responses where dovish policy cues led to investor interest spikes in cryptocurrencies.

Bitcoin Performance Amidst Federal Reserve’s Future Projections

Did you know? The U.S. Federal Reserve’s forecasts have occasionally aligned with crypto market shifts. For instance, past dovish cues often spurred bullish trends in Bitcoin, displaying the monetary policy’s significant influence on risk asset behavior.

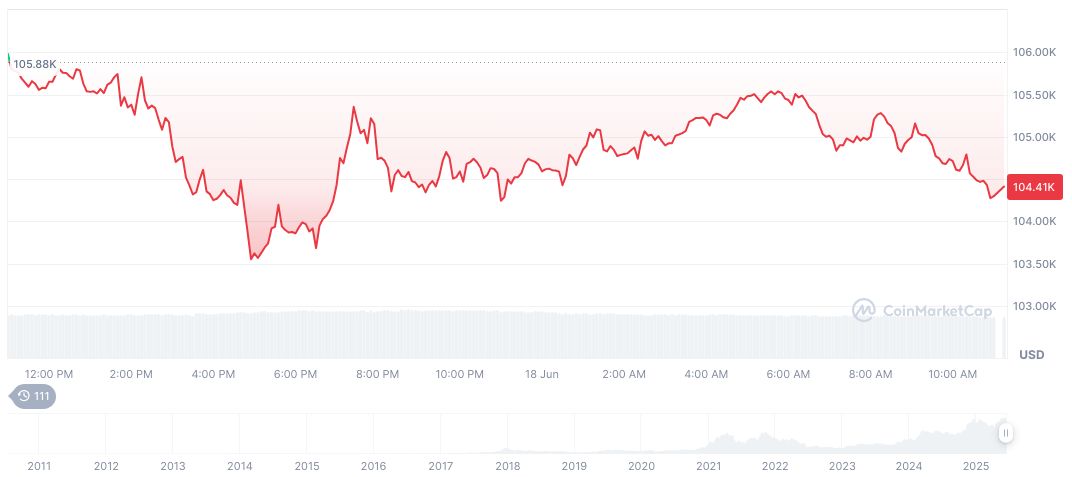

Bitcoin (BTC) stands at $104,913.76, reflecting a market cap of $2.09 trillion, according to CoinMarketCap. Its market dominance is 64.02%, with a fully diluted market cap just over $2.20 trillion. Despite a 24-hour trading volume of $47.92 billion, the value shows mixed performance with recent gains and slight declines.

Coincu research suggests the monetary policy hints of rate cuts for 2025 could positively affect crypto-economic indicators, potentially leading to improved liquidity and investor sentiment. However, any significant crypto market shifts will be carefully monitored, as regulatory changes and market adaptability play crucial roles in the ensuing market dynamics.