The Federal Reserve, through statements by Richmond President Thomas Barkin, has indicated a lack of urgency to alter interest rates amidst enduring inflation uncertainties related to U.S. tariffs. Businesses anticipate rising prices, despite a robust job market with a 4.2% unemployment rate.

Market analysts observe that consistent interest rates may continue as the Federal Reserve assesses data trends. Barkin emphasized a “wait and see” policy, reflecting thoughtful consideration of labor stability and enduring consumer spending. Interest rates remain between 4.25% and 4.5%, implying a steady perspective. You can view the Current U.S. Selected Interest Rates Overview for more detailed figures.

Fed Strategy Amid Tariff and Inflation Concerns

Barkin’s remarks underscore a cautious approach to monetary policy in light of inflationary pressures from potential new tariffs. Businesses within the Richmond district foresee price hikes as tariffs are implemented. Michael Barr, Fed Governor, notes potential disruptions to supply chains could enforce inflation.

Responses from key financial figures and market observers have generally acknowledged Barkin’s statement, with a focus on the Federal Reserve’s deliberate pace. Commentary from Barr highlighted tariffs’ potential impact on inflation and global supply chains, reinforcing a stable rate strategy.

I don’t think the data gives us any rush to cut…I am very conscious that we’ve not been at our inflation target for four years,” said Thomas Barkin, President of the Federal Reserve Bank of Richmond.

Tariff Impact on Crypto and Financial Markets

Did you know? Barkin’s cautious stance echoes the 2018-2019 tariff tumult, when uncertainty prompted similar Federal Reserve approaches, ultimately impacting both traditional and crypto asset volatility.

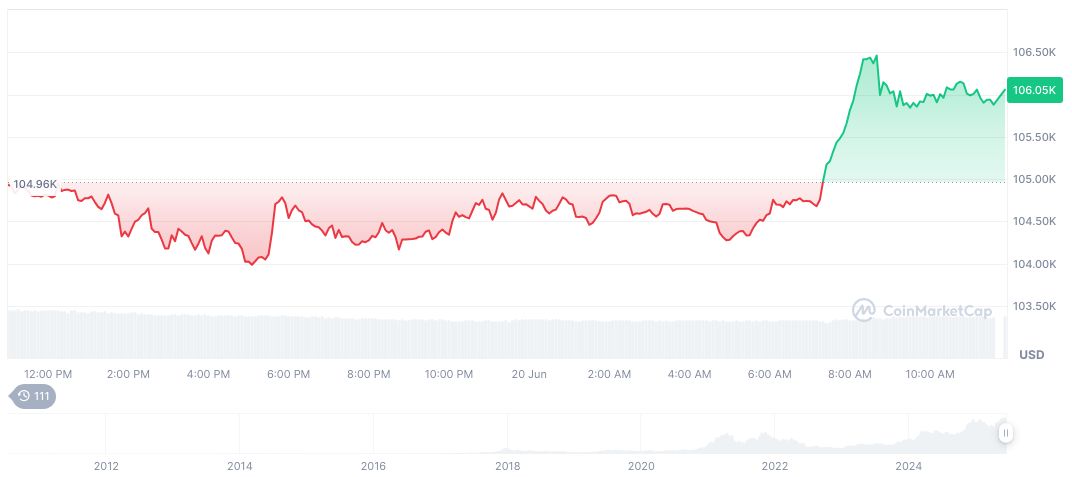

Bitcoin (BTC) remains a focal point amidst macroeconomic uncertainty. As of June 20, 2025, BTC is priced at $103,175.61 with a market cap of $2.05 trillion. Despite short-term declines over 24 hours (1.12%) and 7 days (2.05%), BTC shows positive movement over recent months, marking a 22.48% increase in 90 days, as per CoinMarketCap.

The Coincu research team emphasizes the importance of stability and regulatory consistency as key for cryptocurrency markets. Market volatility is expected to persist amid continuous tariff dialogues. Historical trends reveal how secure yield options in uncertain times might boost strong investments in stablecoins and DeFi investments.