Gold price forecast models are pointing toward $4,000 per ounce as the U.S. dollar continues its decline, according to leading market strategists. This gold price prediction reflects mounting concerns over US dollar weakness, accelerating dedollarisation trends, and sustained central bank gold demand driving precious metal prices to historic levels.

Also Read: Currency: Kyrgyzstan to Launch Gold-Backed, Dollar-Pegged USDKG Stablecoin in Q3

Gold Price Forecast: Impact of U.S. Dollar Weakness and Central Bank Demand

The gold price forecast from State Street Global Advisors suggests unprecedented gains ahead, with bullion already reaching record $3,500 per ounce in late April. Current spot prices hover around $3,370 per ounce as investors pile into the precious metal amid trade uncertainty.

State Street Global Advisors gold strategy head Aakash Doshi had this to say:

“The early days of the Trump administration have corresponded with heightened US economic uncertainty, consumer anxiety, and a weaker US dollar, buttressing investor demand for gold as a tail risk and geoeconomic hedge.”

Mining Stocks Surge on Gold Price Prediction

ASX-listed miners have captured massive gains as gold price forecast models turn bullish. Evolution Mining surged 88 percent, Newmont climbed 41 percent, and Northern Star Resources gained 36 percent this year. These gains reflect expectations that higher gold prices could gift miners the highest margins since the 1980s.

Dollar Weakness Drives Precious Metal Rally

Morgan Stanley’s analysis reveals the US dollar weakness has created ideal conditions for gold’s advance. The dollar index dropped 9 percent while gold jumped almost 30 percent, supported by central bank gold demand and exchange-traded fund inflows.

Morgan Stanley commodities strategist Amy Gower stated:

“We still see upside to gold, with a forecast of $3,500 per ounce by the third quarter but room to overshoot if the current US dollar relationship holds and the US dollar index weakens.”

The current inverse correlation between gold and the dollar has only been this strong seven times since 1990, typically associated with above-average precious metal returns.

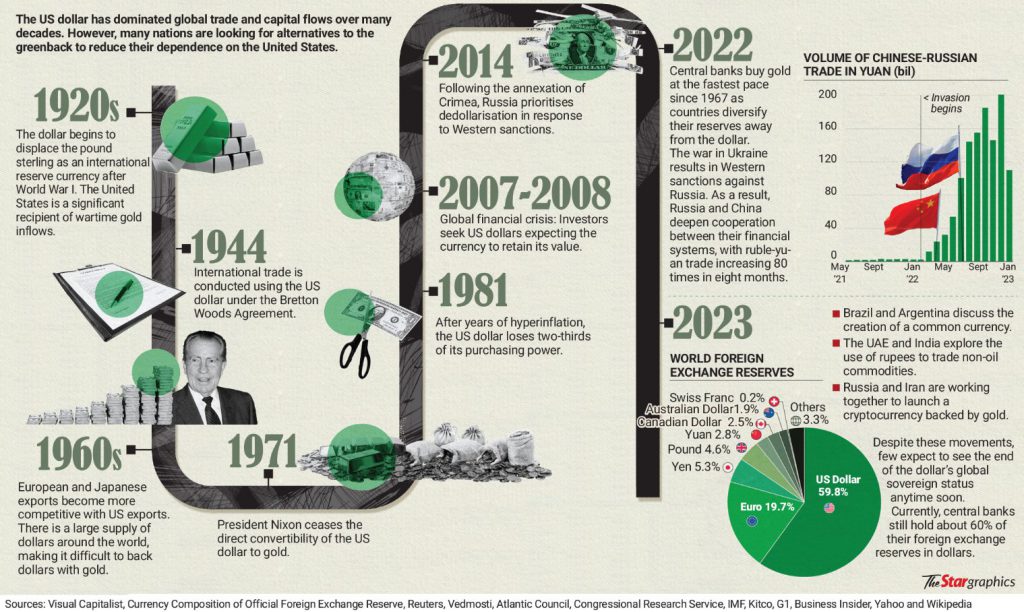

Dedollarisation Trends Support Gold Price Forecast

Trade tensions have intensified following President Trump’s decision to double steel and aluminum tariffs to 50 percent. Recent comments about Chinese President Xi Jinping being “extremely hard to make a deal with” raise questions about economic relations between the world’s largest economies.

UBS Global Wealth’s co-head Adrian Zuercher sees America’s ballooning debt causing investors to lose faith in the currency, creating opportunities for alternative assets like gold.

Also Read: 80% of Americans Want Bitcoin in National Reserves Over Gold

If the dollar index slips to 91 points next year from current levels around 99, gold could reach $3,800 per ounce according to Morgan Stanley’s projections. Uncertainty will likely continue supporting ETF gold inflows as Trump’s July 9 tariff deadline approaches.