Coinbase Institutional recently highlighted the emerging systemic risks from corporate Bitcoin adoption strategies in a report released on June 14, 2025.

Focus on regulatory clarity and market growth is crucial for understanding how and why it matters.

Corporate Bitcoin Holdings Surge Past $88 Billion

Coinbase Institutional, led by David Duong, detailed concerns over systemic risks linked to corporate leveraged purchases of Bitcoin. The number of public companies holding Bitcoin as a treasury asset has risen significantly, illustrating a notable trend in corporate financial strategies. Clear regulatory frameworks and improved economic conditions are expected to support the broader cryptocurrency market’s constructive trajectory over the coming months. The U.S. Financial Accounting Standards Board’s guideline changes have facilitated clearer accounting for crypto holdings, further encouraging corporate adoption. David Duong’s research notes a potential for increased market liquidity due to these changes, while still underscoring systemic risks connected to leveraged purchases. The Bitcoin holdings by public companies have now exceeded 88 billion dollars, inspired by strategies similar to MicroStrategy’s Bitcoin leverage model.

While the rise of publicly traded crypto vehicles brings a new source of demand for crypto, it also raises concern over potential systemic risks; for example, as forced selling from convertible bond maturities could introduce market-wide liquidations.

“While the rise of publicly traded crypto vehicles brings a new source of demand for crypto, it also raises concern over potential systemic risks; for example, as forced selling from convertible bond maturities could introduce market-wide liquidations.” — David Duong, Global Head of Research, Coinbase Institutional Coinbase Research

Bitcoin Market Hits $2.09 Trillion Amid Corporate Adoption

Did you know? More than 130 public companies have adopted Bitcoin-backed balance sheets, following MicroStrategy’s example—a significant leap from past trends.

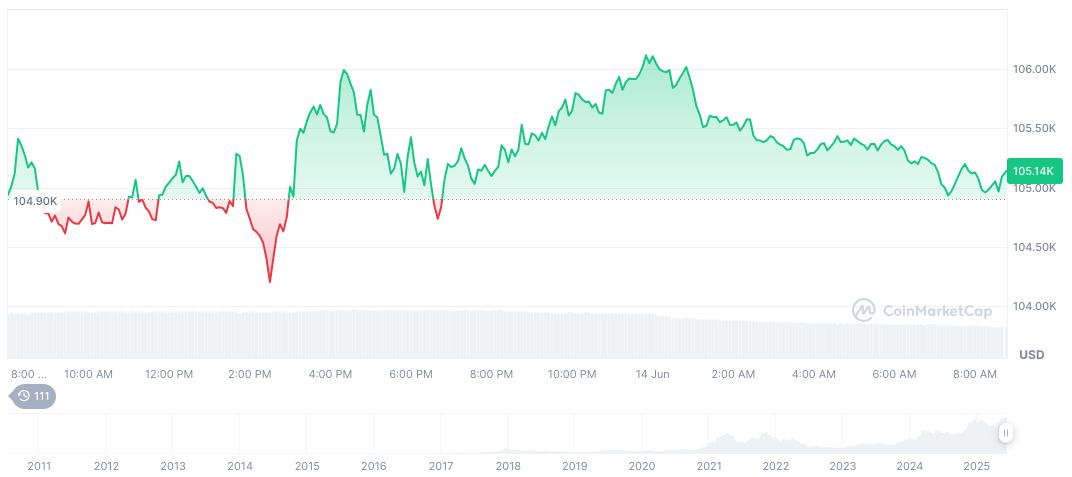

Bitcoin’s latest market data provides a snapshot of current trends: BTC is valued at $105,081.58, maintaining a market cap of $2.09 trillion. Market dominance holds firm at 63.78%, with a 90-day price positive change of 26.60%, according to CoinMarketCap. Corporate Bitcoin adoption aligns with regulatory shifts, and Coincu insights project further enhancements in crypto treasury management practices. Coinbase Institutional anticipates substantial Bitcoin allocations in corporate treasuries leading to robust market integration and closer collaboration between public companies and digital asset platforms.

Coinbase Institutional anticipates substantial Bitcoin allocations in corporate treasuries leading to robust market integration and closer collaboration between public companies and digital asset platforms.