China has issued rare earth export licenses to suppliers of the three major U.S. automakers, Ford, General Motors, and Stellantis, effective for six months. This move, reported on June 6, 2025, is part of ongoing trade discussions.

The issuance reflects critical supply chain dependencies for the automotive sector, potentially impacting electric vehicle production. Concerns mount over supply stability and sustained production across automotive and tech industries.

China’s Strategic Licensing of Rare Earths for U.S. Autos

China’s Bureau of Industrial Security and Import and Export Control granted the rare earth export licenses as part of discussions involving higher-level negotiations between U.S. and Chinese authorities. The licenses allow U.S. automakers a limited six-month period for resource acquisition across essential production lines. Hildegard Müller, president of Germany’s auto industry association, stated, “China’s rare earth export restrictions pose a major threat to supply security.”

Industry response to these license grants has highlighted concerns over potential delays. These could destabilize broader supply chains. The strategic nature of the move suggests a delicate balance in achieving competitive parity amidst resource scarcity.

The issuance of rare earth export licenses to U.S. automakers marks a significant moment, reminiscent of earlier periods where geopolitical tensions led nations to reconsider their strategic resource dependencies.

Geopolitical Tensions and Market Uncertainty Loom

Did you know? Rare earth elements are essential for the production of many high-tech devices and electric vehicles, making them a strategic resource in global trade.

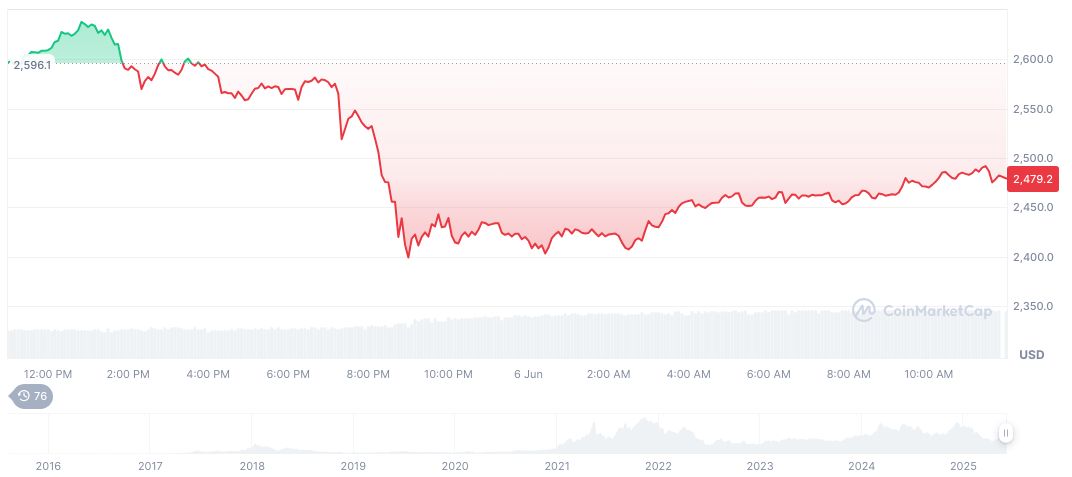

Ethereum (ETH) currently holds a market cap of $303.44 billion with a trading volume of $28.09 billion, reflecting a 60.12% change over the past 24 hours. Recorded by CoinMarketCap at 15:24 UTC on June 6, 2025, the price stands at $2,513.53, down 3.08% in 24 hours.

Coincu analysts speculate on potential ripple effects in the tech industry due to the announced licensing. The event is expected to stimulate the search for alternative supply chains. This move is positioned strategically in anticipation of longer-term shifts in production sourcing.