Cardone Capital‘s Bitcoin investment strategy has caught attention with a groundbreaking $101 million purchase that establishes the company as a pioneer in cryptocurrency adoption. This large Bitcoin purchase represents the first time a real estate company has fully integrated Bitcoin into its core business model, signaling a major shift in institutional Bitcoin buying practices. The move comes amid Bitcoin market volatility, yet demonstrates confidence in long-term Bitcoin accumulation plans.

CardoneCapital adds ~1000 BTC to balance sheet becoming first ever real estate/btc company integrated with full BTC strategy, combining the two best in class assets

14,200 units plus half million square feet of A* office the group expects to add another 3000 BTC and 5000 units… pic.twitter.com/XvOCO9NkoE

— Grant Cardone (@GrantCardone) June 21, 2025

Also Read: Bitcoin, ETH, XRP & SOL Soar on Israel-Iran Ceasefire and Fed Rate Cuts

Cardone Capital’s Bitcoin Growth Plan Amid Market Volatility And Accumulation Strategy

Historic Bitcoin Integration Strategy

Cardone Capital’s Bitcoin holdings now include 1,000 BTC worth approximately $101 million, making it the first real estate/BTC company to achieve full Bitcoin strategy integration. This institutional Bitcoin buying decision combines traditional property investments with digital assets in an unprecedented way.

Grant Cardone stated:

“CardoneCapital adds ~1000 BTC to balance sheet becoming first ever real estate/btc company integrated with full BTC strategy, combining the two best in class assets”

The company’s large Bitcoin purchase reflects growing confidence in cryptocurrency’s role within traditional investment portfolios, despite ongoing Bitcoin market volatility concerns.

Ambitious Expansion Plans

The Cardone Capital Bitcoin strategy extends far beyond the initial investment. The company has announced plans for significant growth across both digital and physical assets.

Grant Cardone had this to say:

“14,200 units plus half million square feet of A+ office the group expects to add another 3000 BTC and 5000 units this year.”

This Bitcoin stacking strategy shows that the company is ready to increase its stock of cryptocurrencies and still concentrating on real estates development. This institutional bitcoin purchasing method makes Cardone Capital one of the gold standards of a hybrid investment strategy.

Market Impact and Future Outlook

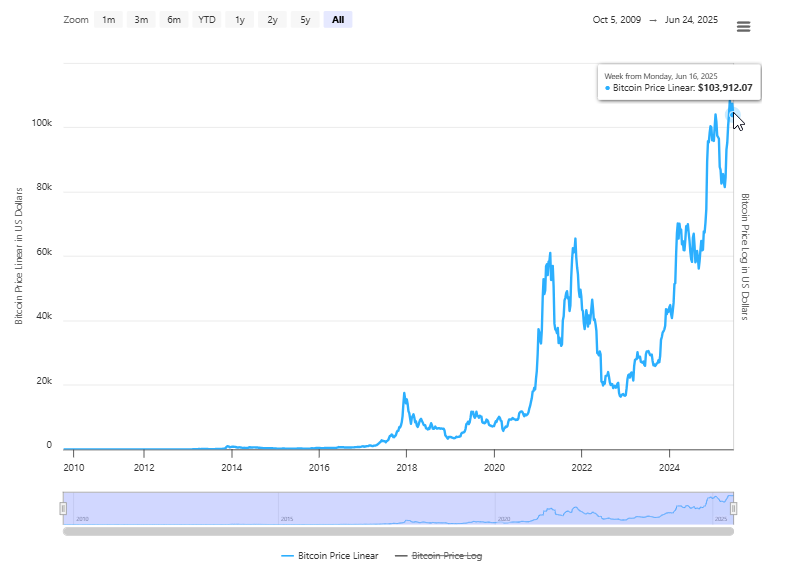

The Cardone Capital Bitcoin announcement has generated significant attention within both real estate and cryptocurrency sectors. This large Bitcoin purchase comes at a time when Bitcoin market volatility has created both opportunities and challenges for institutional investors.

The Bitcoin accumulation strategy carried by the company is not simply a diversification strategy rather it is a radical change in terms of the traditional business position to the digital asset integration context. Cardone Capital is bringing together a new institutional model of purchasing Bitcoin by integrating real estate knowledge and cryptocurrency investments.

Also Read: Metaplanet’s $5 Billion Bitcoin Bet Surpasses Coinbase Holdings

The success of this Cardone Capital Bitcoin strategy could influence other real estate companies to consider similar moves, potentially accelerating institutional Bitcoin buying across the sector despite Bitcoin market volatility concerns.