BlackRock has begun purchasing Ethereum (ETH) for its ETH staking ETF. According to the filing, the ETH staking yield is estimated to average out at 3% annually. The firm reached the 3% figure in reference to early 2026 benchmarks. The filing notes that investors will receive 82% of gross staking rewards. The fund sponsor and execution partner will keep the remaining 18%. Investors will also have to pay a sponsor fee of 0.12% to 0.25% of the investment value and also a staking fee. With the world’s largest asset manager amping up its ETH purchase, will the underlying asset experience a price surge in the coming weeks? Let’s discuss.

Will Ethereum Rally After BlackRock Begins Purchases For Its Staking ETF?

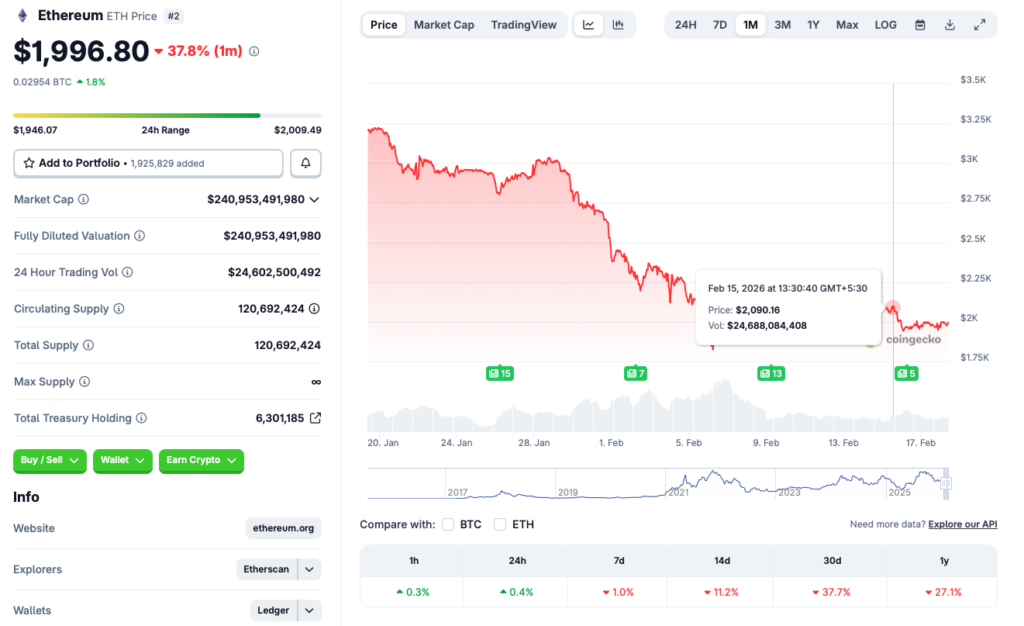

Ethereum’s (ETH) price has struggled to see any positive price action over the last few months. The asset briefly reclaimed the $2000 price level over the last weekend, but has since faced another correction. According to CoinGecko data, Ethereum’s (ETH) price is down 1% in the last week, 11.2% in the 14-day charts, and 37.7% over the previous month.

Ethereum’s (ETH) downward momentum began in late 2025, after the October market crash. Before the market dip, ETH was having quite a jolly ride. The asset climbed to a new all-time high of $4,946.05 in August 2025, after nearly four years. However, Ethereum’s (ETH) price has fallen by nearly 60% from its peak.

Increased ETF inflows was one of the key drivers for Ethereum’s (ETH) price in 2025. BlackRock’s recent Ethereum (ETH) purchases for its staking ETF could have a similar impact on the asset.

Also Read: Top Ethereum Price Predictions That Could Make Your Day

Nonetheless, the crypto market is still weak and retail investors are staying away from risky assets. While institutional money could lead to price rebound for Ethereum (ETH), the lack of retail players may lead to a delayed bull run.