Bitcoin treasury reserve firms are pressuring traditional companies by gaining index inclusion, prompting market focus on June 15.

The integration of Bitcoin in corporate treasuries is actively reshaping market index compositions and heightening the relevance of Bitcoin in global economic strategies.

Bitcoin Reserves Reshape Traditional Market Indices

Bitcoin Magazine CEO David Bailey and Blockstream CEO Adam Back have publicly discussed the impact of Bitcoin treasury reserve companies on traditional indices. Their statements emphasize how companies lacking digital assets are being excluded from indices, highlighting a shift in capital reallocation.

The push for Bitcoin as a treasury reserve is gaining momentum, with potential implications for market resilience and liquidity. As cryptocurrencies become essential parts of traditional indices, market dynamics are undergoing significant realignment.

“What really pisses them off is that every time one of our Bitcoin treasury reserve companies gets included in an index, a traditional company that doesn’t hold Bitcoin gets kicked out. Sorry, your liquidity has now become Bitcoin’s liquidity. Join, or be left behind.” — David Bailey, CEO, Bitcoin Magazine

Community leaders, like Bailey, assert that traditional companies must adapt or risk competitive disadvantage. Back’s remarks highlight Bitcoin as a critical asset, urging public companies to explore its role in treasury strategies.

Bitcoin’s 25% Growth Spurs Treasury Strategy Shifts

Did you know? The rise of Bitcoin as a corporate asset traces back to MicroStrategy’s 2020 purchase, setting a precedent for institutional Bitcoin adoption that continues to influence global financial strategies today.

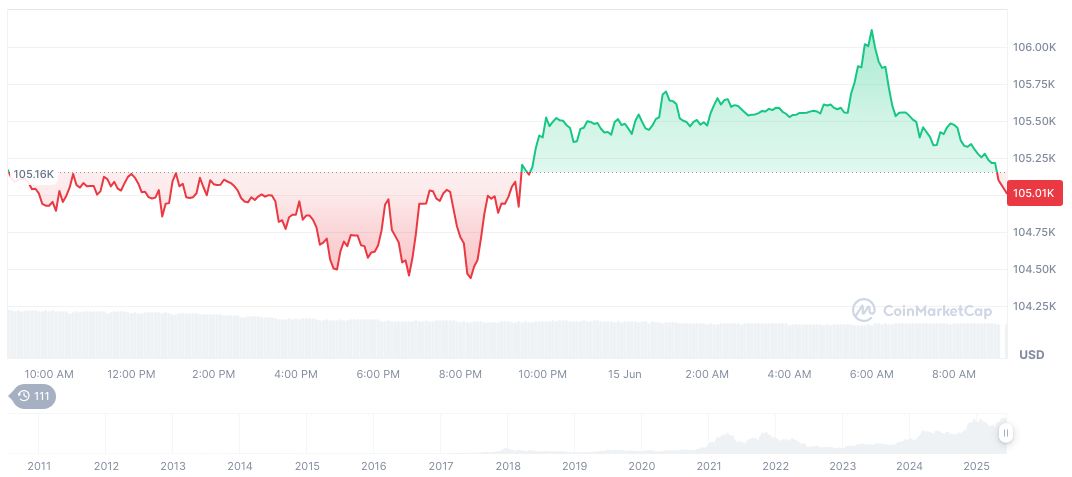

As of June 15, 2025, Bitcoin’s market dynamics reflect sector shifts, with notable figures from CoinMarketCap: BTC trades at $104,996.26, holds a market cap of $2,087,115,571,964.30, and commands 63.91% dominance. Despite minor price dips, its quarterly growth features a 25.03% climb over 60 days.

According to Coincu insights, Bitcoin’s growing integration in company treasuries signifies a paradigm shift. Potential outcomes include enhanced liquidity, increased investor trust, and a shift towards crypto-stable reserve strategies. This positions Bitcoin in key financial strategy dialogues.