Binance, led by CEO Richard Teng, dominates central exchange stablecoin reserves with an impressive $31 billion in USDT and USDC. This marks Binance’s prominent role in sustaining high liquidity, even as cryptocurrency prices rebound.

Binance Leads with $31 Billion in Stablecoins

June’s data, released by CryptoQuant, highlights Binance as the leader in stablecoin reserves among centralized exchanges, holding $31 billion—a noteworthy 59% of such holdings. In total reserves, Coinbase tops the charts with $129 billion in assets, while Binance closely follows with $110 billion.

The change in stablecoin reserves at Binance marks a significant shift in market liquidity dynamics. This surge is underpinned by institutional inflows, aligning with Binance’s recent statements about maintaining a strong solvency above 100% reserves over 30 months.

Market observers, including CryptoQuant analyst Darkfost, anticipate a price rebound in major cryptocurrencies such as Bitcoin and Ethereum. Richard Teng and the Binance team remain publicly silent on these developments, but official blogs affirm their commitment to liquidity and transparency.

Institutional Inflows Fuel Market Liquidity Shift

Did you know? Binance’s surge to $31 billion in stablecoin reserves is a fivefold increase from its June 2023 levels, signaling a major institutional trust and liquidity factor.

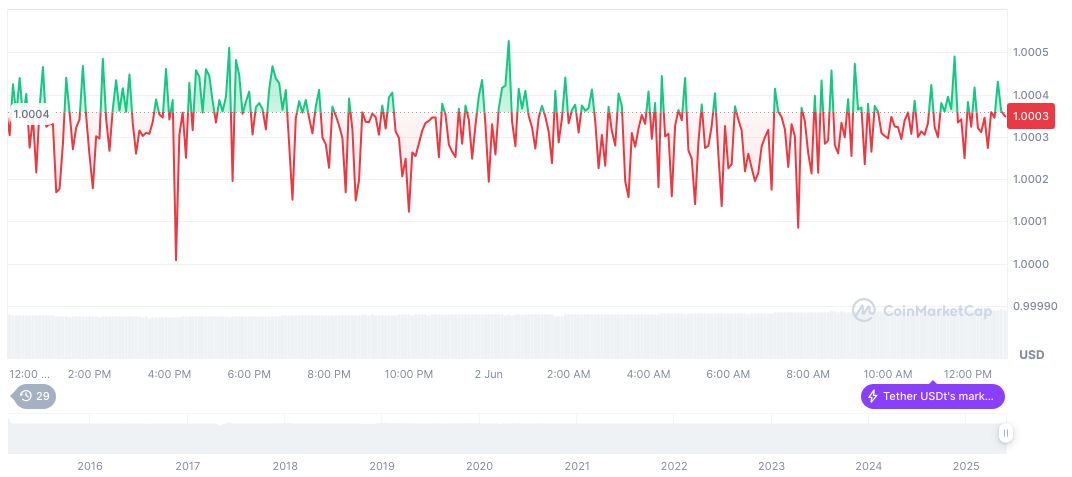

According to CoinMarketCap, Tether USDt (USDT) is priced at $1.00, with a market cap of $153.39 billion and market dominance at 4.63%. The 24-hour trading volume stands at $71.35 billion, marking a 24.64% increase. Recent shifts show a 0.01% change over 24 hours.

Binance’s leading stablecoin reserves reflect a potentially positive market trajectory. Insights from the Coincu research team suggest that rising reserves indicate increased institutional participation, likely fortifying market resilience against regulatory shifts and supporting bullish trends. Strong trends similar to these remind industry insiders about the recent developments outlined by Singapore Exchange.

“Binance has maintained a reserve ratio above 100% for 30 consecutive months,” affirming high solvency and emphasizing transparent proof-of-reserves audits validated by third parties.