Binance, the largest cryptocurrency exchange by trading volume, will modify the collateral ratio for certain assets on June 20, 2025, starting at 14:00 (UTC+8). Additionally, updates to leverage and margin ladder structures for USDT-margined perpetual contracts are slated for the week of June 17, 2025.

This represents a move towards updated risk management strategies in volatile markets. Immediate market impact will hinge on these changes, driving significant shifts in user positions and trader strategies.

Binance Implements New Collateral and Leverage Adjustments

Binance is set to adjust its collateral ratios in unified accounts, impacting assets in its portfolio. This step continues its strategy to align risk controls with market dynamics. Key contracts, including BTCUSDT, will see updates aimed at refining leverage structures.

Despite the absence of CEO Richard Teng’s public commentary, Binance’s approach underscores an evolving focus on compliance and risk management. No regulatory body has issued new directives on this, yet industry observers view it as a proactive alignment with broader oversight trends.

“As of June 15, 2025, there were no available quotes or public commentary from key players, executives, or crypto influencers regarding the Binance collateral and margin adjustments. All information regarding these updates has been primarily sourced from Binance’s official announcements and support channels.”

Bitcoin Market Dynamics Amid Binance Changes

Did you know? Binance’s previous margin updates have historically been a response to changing market conditions, traditionally prompting users to adjust their trading strategies in line with the updated parameters.

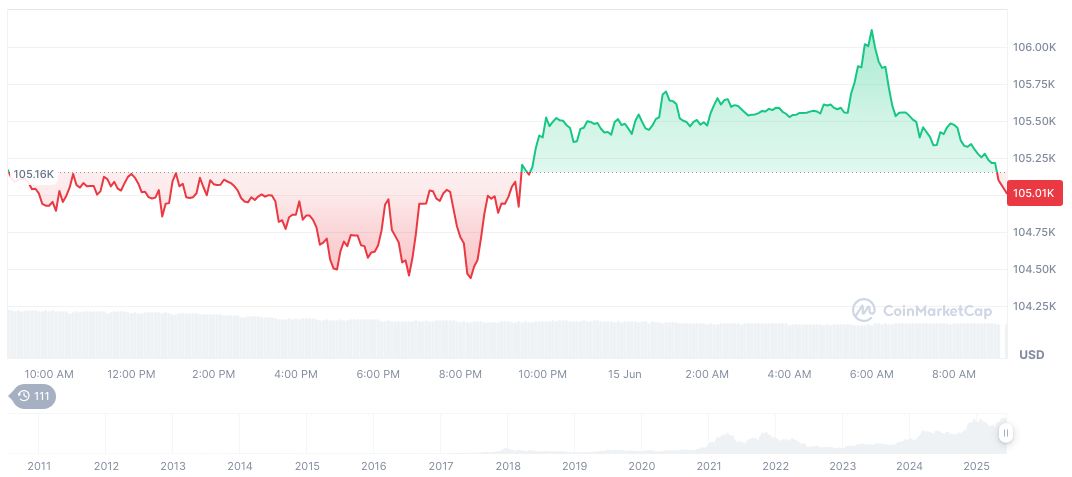

Bitcoin (BTC) currently trades at $105,594.20, with a market cap reaching 2.10 trillion dollars. According to CoinMarketCap, BTC’s 24-hour trading volume is at 36.75 billion dollars, marking a decline of 3.72%. Recent price fluctuations show a steady rise of 25.55% over 90 days, reflecting a positive market sentiment.

Insights from the Coincu research team suggest the updated collateral and leverage requirements could result in substantial strategic adjustments among traders. Historical data indicates such changes may moderate volatility while managing risk exposure, aligning user activity with evolving market conditions.