19h05 ▪

5

min read ▪ by

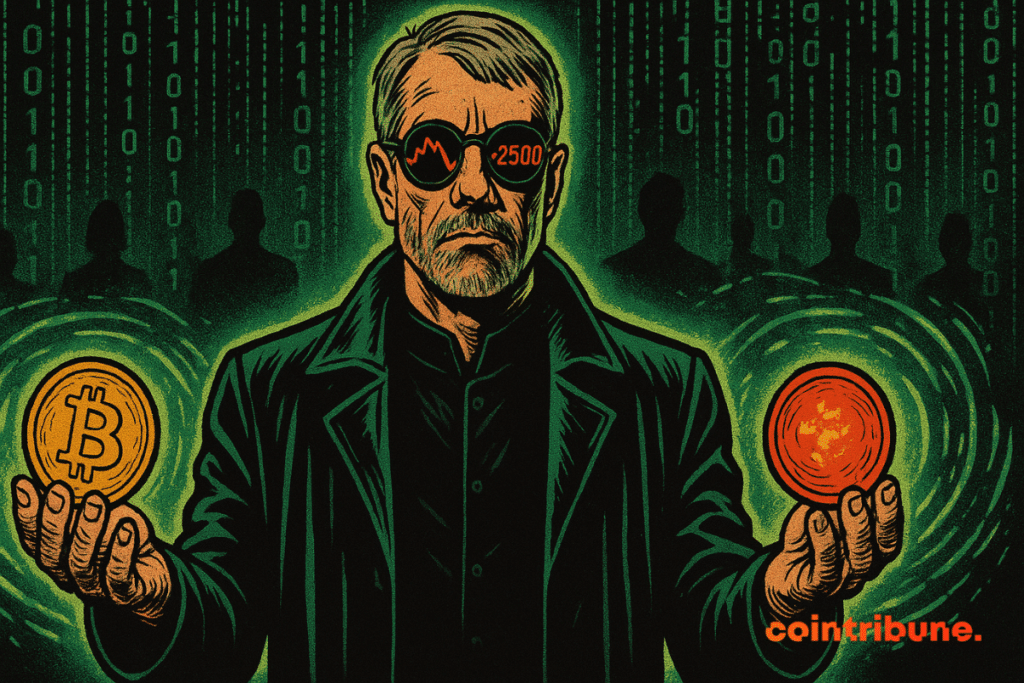

While bitcoin staggers under blows of brutal volatility, an enigmatic tweet from Michael Saylor adds fuel to the fire. An AI-generated image, a nod to Matrix, and this cryptic sentence: “Tickets to escape the Matrix are sold in bitcoin.” Is it just a joke? Or a coded message for those who still know how to read between the lines?

In brief

Michael Saylor posts a Matrix-inspired image while bitcoin drops sharply.

Despite the decline, large holders continue to accumulate BTC, while small investors give up.

Saylor’s message mixes symbolism and strategy to revive faith in bitcoin.

When bitcoin falls, Saylor puts on Morpheus’s coat

The timing is no accident. While bitcoin plunges from $106,000 to $103,400 in a few hours—a drop of 2.33%—Saylor, the patriarch of bitcoin faith at MicroStrategy, brandishes a reference to the cult film by the Wachowski brothers. In Matrix, escaping the fake reality involved a phone handset. Today, according to him, bitcoin acts as the gateway.

This message arrives in a tense context. In a few days, BTC has lost nearly 5%, and the entire market is holding its breath. Yet, far from giving in to panic, Saylor seems to invite us to look beyond the numbers. The parallel is clear: just as Neo had to choose between the blue pill and the red, investors must decide whether to remain prisoners of the fiat system or embrace bitcoin’s radical freedom.

But deep down, this tweet is not just a play of symbols. It is also a demonstration of narrative resilience. Saylor does not deny the fall; he transcends it through storytelling. A controlled, almost hypnotic strategy that keeps the ideological momentum even when the charts turn red.

Between faith, irony, and contradictions

What is striking is Saylor’s ambivalent position. While he shares the libertarian imagery of Matrix, he does not share the visceral hostility towards banks or centralized intermediaries. He proved this when he criticized those who advocate self-sovereignty as the only path. An irony for someone who champions bitcoin as a tool of emancipation.

In reality, Saylor is not a purist; he is a strategist. His goal is clear: to accumulate bitcoin on a large scale while maintaining a sufficiently flexible discourse so as not to frighten institutions. He flirts with the codes of the cypherpunks but remains attached to a corporate treasury logic.

This hybrid stance allows him to navigate between two worlds: that of idealists and that of pragmatists. And his Matrix tweet, under the guise of philosophical provocation, is perhaps an attempt to reconcile these two universes—or to skillfully manipulate them.

The fear of the small, the conviction of the whales

While some see hidden messages in Saylor’s GIFs, on-chain data tells another story. According to Santiment, wallets holding more than 10 BTC continue to accumulate. 231 new wallets in ten days. A sign of confidence? Better: an act of faith. The “whales” do not abandon ship.

Conversely, modest wallets are abandoning the field: 37,465 of them have liquidated their positions. A silent purge. The hemorrhage of small holders is nothing new but it is revealing: in every bearish phase, Bitcoin transfers wealth from those who doubt to those who believe.

Historically, this dichotomy between small sellers and large accumulators often precedes bullish reversals. It is at these moments of apparent despair that the market is reshaped. And Saylor knows it. Hence this not-so-veiled message: stay awake.

Bitcoin, with its volatility, its paradoxes, and its prophets, continues to challenge us. By waving the metaphor of Matrix, Saylor does not just troll Twitter. He reminds those who listen that behind the numbers lies a battle of ideas. And those who choose the red pill—or rather bitcoin—must be prepared to weather the storm. Even when the market sways and small investors flee.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.