Ant International and Lianlian Digital are applying for stablecoin licenses in Hong Kong amid major financial sector changes announced by the Hong Kong Monetary Authority.

Ant and Lianlian Seek Compliance with HKMA Rules

Ant International and Lianlian Digital aim to obtain Hong Kong licenses under the Hong Kong Monetary Authority’s new regulatory regime. Ant International is associated with Ant Group, while Lianlian Digital is venturing into similar regulatory compliance. Both companies are aligning with regulatory objectives to enhance stablecoin transparency and operational security. Bian Zhuoqun of Ant Group emphasizes building a compliant and efficient trading ecosystem.

Hong Kong’s regulatory clarity could shape international stablecoin dynamics, with industry players like Mastercard preparing for stablecoin integration by 2025.

Their core value lies in expanding application scenarios and ensuring compliance.

— Bian Zhuoqun, Vice President of Ant Group and President of Blockchain Business at Ant Digital Technologies

Regulatory Shifts Boost Stablecoin Market Dynamics

Did you know? Hong Kong’s regulatory framework resembles efforts in Singapore and Europe’s MiCA, likely fostering stablecoin adoption and business use, expanding market volumes, and increasing transparency.

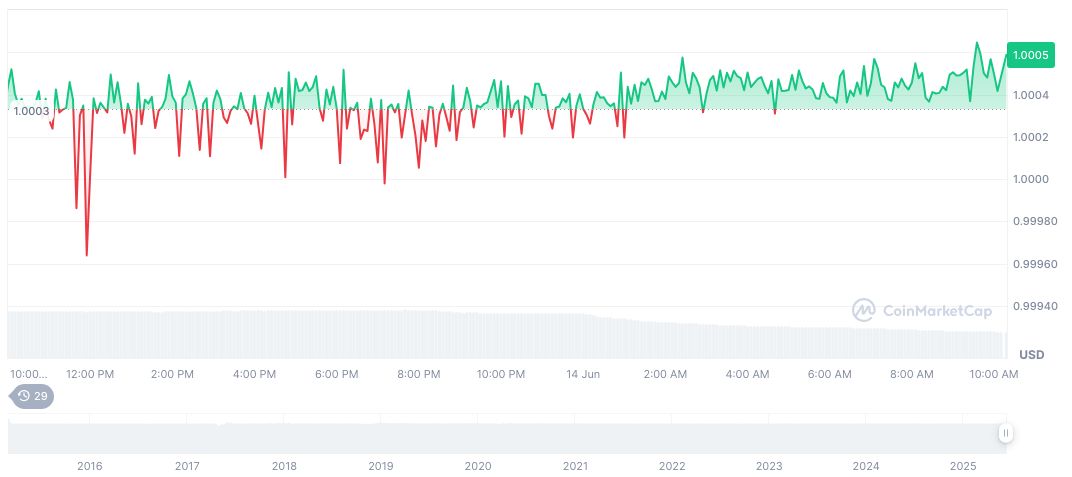

Tether USDt (USDT) holds a steady value of $1.00, with a market cap of $155.53 billion and market dominance of 4.76%, according to CoinMarketCap as of June 14, 2025. Despite its volatile trading volume dropping 42.88% in 24 hours, its circulation remains robust with 155.47 billion coins.

Recent regulatory moves underscore the potential for a stabilized and regulated stablecoin market. Coincu research highlights a trend toward compliance-driven growth, expecting strategic, compliant expansions within the digital currency sector. This aligns with historic regulatory impacts improving transparency and adoption.