14h05 ▪

5

min read ▪ by

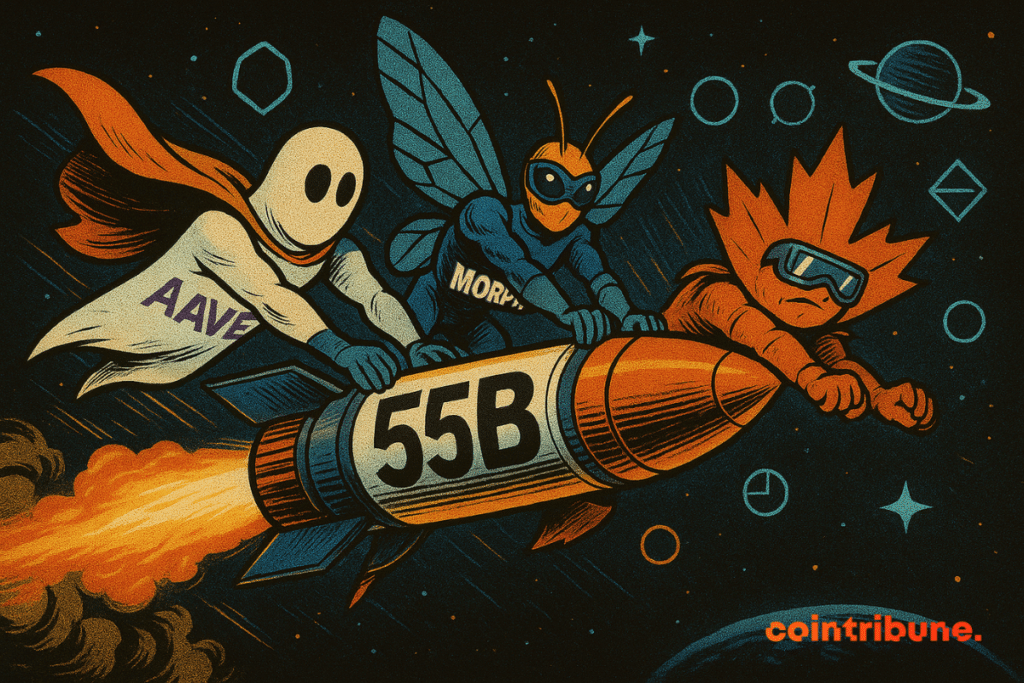

Decentralized finance is no longer a techno-utopia for maximalist developers. It has become a cornerstone of the crypto economy. Far from the speculative bubbles of the past, today’s DeFi attracts capital, generates revenue, and structures sustainable use cases. Its pillars, such as Aave, Morpho, or Maple, build an alternative to traditional finance with rigor and performance. And the numbers speak for themselves.

In brief

DeFi lending TVL reaches 55.7 billion dollars, breaking all previous historic records.

Aave generates 1.6 million dollars per day and its token far outperforms Bitcoin.

Morpho attracts institutions with a modular architecture and an annual growth of 38%.

Maple explodes to 1.37 billion dollars in TVL thanks to uncollateralized real asset lending.

A Historical Peak for DeFi: Billions Locked in Loans

In early June 2025, DeFi crossed a symbolic milestone. The total value locked (TVL) in its lending protocols exceeded 55.7 billion dollars. This is more than the peaks reached in 2021, 2022, and 2024. And it’s not a flash in the pan.

Aave v3, a historic figure of crypto lending, saw its TVL climb 55% in two months. In April, it peaked at 16.87 billion dollars. By early June, it was close to 26.09 billion. The revenue side showed the same momentum: 1.6 million dollars generated daily versus 900,000 dollars in April. This growth is fueled by multichain expansion and an ever-active community.

The AAVE crypto is not left behind: +65% over three months. Over the same period, Bitcoin gained 26%. The community is pleased. On X, some users highlight the protocol’s solidity. And the numbers reinforce this image.

Behind this DeFi surge is an ecosystem becoming professionalized. Aave is becoming a go-to for arbitrage, collateral, and automated strategies. This TVL boom is not an anomaly; it reflects renewed confidence in decentralized finance mechanisms.

Three Protocols, Three Visions: Aave, Morpho, Maple

This record is not the work of a single player. Morpho Blue and Maple Finance have also contributed significantly. Their models differ from Aave but share one ambition: rethinking crypto credit.

Morpho Blue, which shows a TVL of 3.9 billion, bets on a modular protocol. Here, lenders build their market with adjustable parameters. Result: +38% since January. Morpho is establishing itself as the DeFi option for institutions.

Maple takes another approach. Its TVL reaches 1.37 billion, up 417%. Its specialty? Uncollateralized lending on real-world assets. Thanks to its “sovereign pools”, any delegate can extend credit—provided they verify client data on-chain.

Its SYRUP token, launched in May 2025, jumped 140%. A strong signal: investors believe in this more flexible model, closer to traditional finance.

These three visions coexist. They meet different uses. Aave serves the masses. Morpho addresses managers. Maple bridges DeFi and off-chain financing. This diversity feeds the ecosystem and strengthens its resilience.

The Crypto Lending Market: Between Consolidation and Persistent Risks

Beyond DeFi, the overall crypto lending market remains dynamic but contrasted. In 2021, outstanding loans reached 64.4 billion dollars. By the end of 2024, they fell to 36.5 billion dollars. In 2025, recovery is visible but measured.

In Q1 2025, the market reached 39.07 billion dollars, down 4.9% quarter-over-quarter;

CeFi still dominates with 88.6% market share thanks to Tether, Galaxy, and Ledn;

DeFi lending rebounds: +959% since its low point in early 2023;

Interest rates on stablecoins fell from 11.6% to 5% since January;

Companies such as Strategy accumulate 2.1 billion dollars in crypto loans to finance their operations.

But not everything is rosy. As Galaxy Research wrote, crypto lending remains sensitive to the volatility of collaterals. Massive margin calls can occur at the slightest market downturn.

Regulation remains pending. And systemic risk, even decentralized, has not disappeared. However, the progress of DeFi lending reflects a gradual rebalancing, where usage and structuring prevail over pure speculation.

We are living through a turning point in the crypto market. The DeFi comeback, combined with the boom of real-world assets (RWA), confirms a dynamic highlighted by Binance Research. The rise of lending, the performance of Aave, Morpho, and Maple, and the growing interest in Ethereum signal a profound rebalancing of the landscape.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.