Bitcoin (BTC) is at one of its most bearish territories of the last few years. Data shows that BTC’s strongest holders are not buying the dip like they did before. Currently, we are seeing the lowest “buying the dip” data since the 2022 Terra-LUNA crash. Moreover, veteran holders are taking on losses on their Bitcoin (BTC) positions. Let’s discuss what’s next for the largest cryptocurrency by market cap. Will Bitcoin (BTC) investors continue taking losses, or will the asset enter a recovery phase soon?

With Investors Taking Losses, Will Bitcoin Weather Through The Storm?

Bitcoin’s long-term holders buying the dip is at around the same level as after the Terra-LUNA debacle of 2022. BTC’s price took another dip after the collapse of FTX in November 2022, falling to the $15,000 level. However, this time around, the dip is not triggered by a bank run. Instead, the current market crash was triggered by macroeconomic uncertainties, geopolitical tensions, and a liquidity crunch. Bitcoin’s (BTC) price will likely rebound once the larger economy improves.

Also Read: Harvard Sells BlackRock Bitcoin ETF, Choses Ethereum Instead

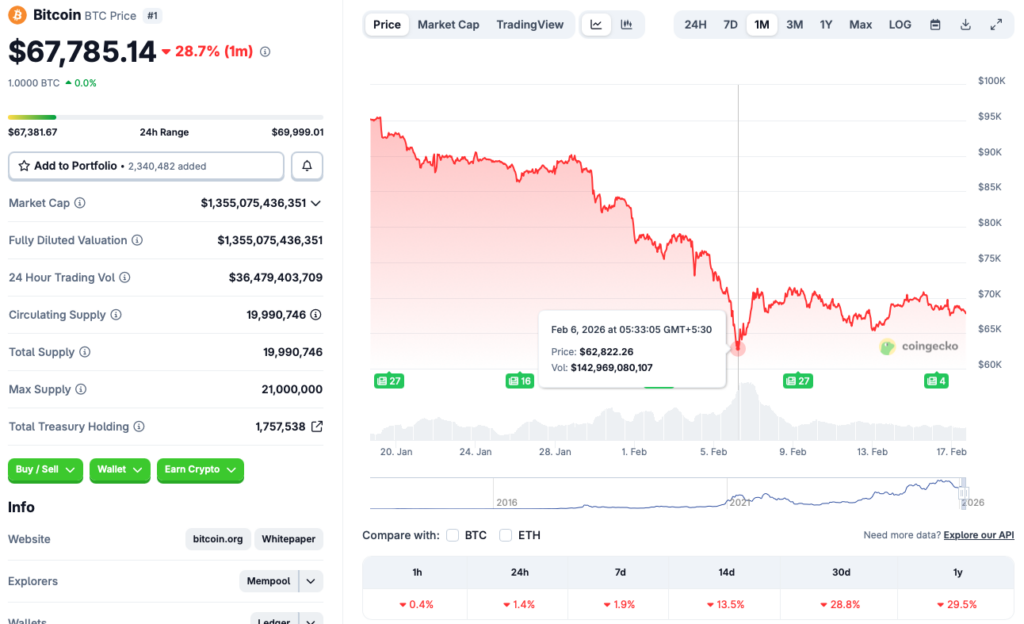

However, Bitcoin’s (BTC) may see further corrections before any bullish developments. According to CoinGecko data, BTC has once again dipped below the $68,000 mark today. The original crypto fell to the $62,000 level earlier this month, and may dip below that in the coming days.

Stifel analysts anticipate Bitcoin (BTC) to dip to the $38,000 level this cycle. If Bitcoin (BTC) falls to the $38,000 price level, investors may begin a buying spree. Moreover, Deutsche Bank analysts anticipate around $11 billion in tax refunds this year. The bank expects the refunds to enter the US equities market. There is a possibility that some of this money would enter the crypto market as well. Such a development could lead to a price bump for Bitcoin (BTC).