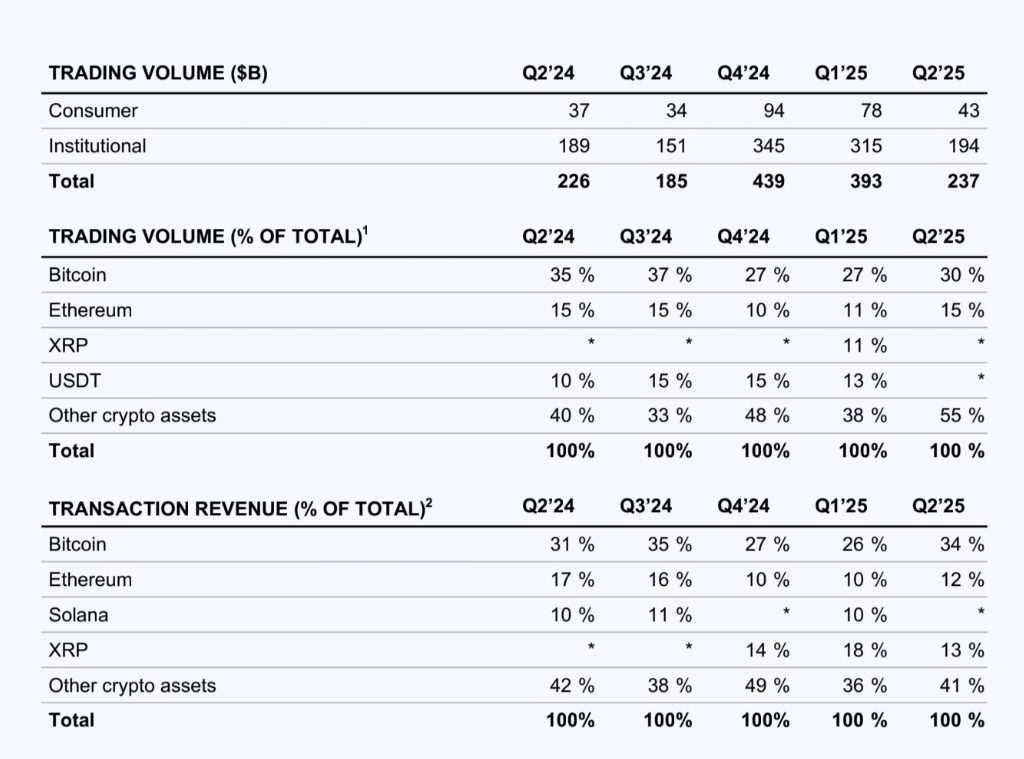

XRP’s Coinbase earnings have actually delivered quite a surprise in the latest quarterly results, with the token managing to capture around 13% of transaction revenue in Coinbase’s Q2 2025 report. This performance actually beats Ethereum’s 12% share, which is pretty significant when you think about it. The XRP institutional demand has been growing, and this shift in the XRP vs Ethereum dynamic is being watched closely right now. At the time of writing, this XRP price prediction catalyst from the Coinbase Q2 report is creating some buzz.

XRP’s Coinbase Earnings Surge Amid Institutional Demand and Ethereum Dip

The official Q2 2025 shareholder letter from Coinbase shows that total revenue came in at $1.5 billion, with transaction revenue making up $764 million of that figure. What’s interesting about these XRP Coinbase earnings is that XRP managed this feat even though it didn’t actually reach the 10% trading volume threshold that Coinbase discloses separately. This kind of revenue efficiency shows stronger XRP institutional demand patterns taking hold.

Also Read: XRP Price Prediction: Where Will Ripple Be In The Next 10 Years?

Looking at the numbers, Bitcoin still dominated things with 34% of transaction revenue and also 30% of the trading volume. But XRP’s 13% revenue share actually exceeded what Ethereum managed to pull in at 12%, and this happened even with XRP having lower trading volumes overall. This XRP vs Ethereum flip is pretty notable and suggests that institutional preferences might be shifting around. The XRP price prediction models are getting some support from these utility-driven patterns that showed up in the Coinbase Q2 report.

Technical Analysis Shows Some Bullish Patterns

$XRP has broken out of a bullish flag, setting its sights on $15! Zoom out on the weekly chart and you’ll spot it. pic.twitter.com/DXVp6G18os

— Ali (@ali_charts) July 22, 2025

Market analysts have been identifying what they see as strong technical patterns that could support continued XRP Coinbase earnings growth going forward. The XRP institutional demand surge is actually coinciding with some breakout formations that technical analysts believe might drive significant price appreciation.

Also Read: Here’s Why XRP Could Hit $5 Post White House Recommendation

The combination of these strong XRP Coinbase earnings, along with rising XRP institutional demand, and also the positive XRP vs Ethereum metrics that came out in the Coinbase Q2 report creates multiple catalysts working together right now.

This convergence is actually supporting some of the more optimistic XRP price prediction models as institutional adoption continues to accelerate through these proven revenue generation capabilities.