On June 20, 2025, Thailand’s Securities and Exchange Commission (SEC) announced the start of a public consultation on proposed new rules for digital asset listings.

These proposed regulations seek to enhance market transparency and align with global trends in cryptocurrency regulation.

Thailand SEC Pushes for Enhanced Token Transparency

The Securities and Exchange Commission of Thailand announced a public consultation on draft regulations for digital asset exchanges. This initiative, announced on June 20, aims to allow exchanges to list digital tokens that they or their affiliates issue, provided they adhere to stricter disclosure and supervision standards. The consultation period remains open until July 21, 2025, inviting input from stakeholders and interested parties.

The central change involves increasing transparency and instituting measures against insider trading. Exchanges must now provide comprehensive information about people closely associated with token issuers, enhancing the market’s capacity for oversight and integrity. Additionally, these regulations propose the use of visual warning signals within reporting systems to spotlight any flagged tokens, aiming to weigh in on investor protection.

“This public consultation is an important step in aligning our protocols with global crypto trends, ensuring both innovation and regulatory compliance.” — Securities and Exchange Commission of Thailand (SEC)

Market responses have yet to surface significantly, with few publicly recorded statements from monetary leaders or prominent industry figures following the release. However, this lack of immediate commentary does not diminish the potential discussion surrounding market implications of these proposals and Thailand’s broader ambition to position itself as a leading financial and cryptocurrency hub in Asia.

Thailand’s 2024 Tax Abolition Boosts Crypto Market Sentiment

Did you know? In 2024, Thailand abolished capital gains tax on crypto sales, projecting a 1 billion baht economic benefit, demonstrating consistent support for digital asset markets.

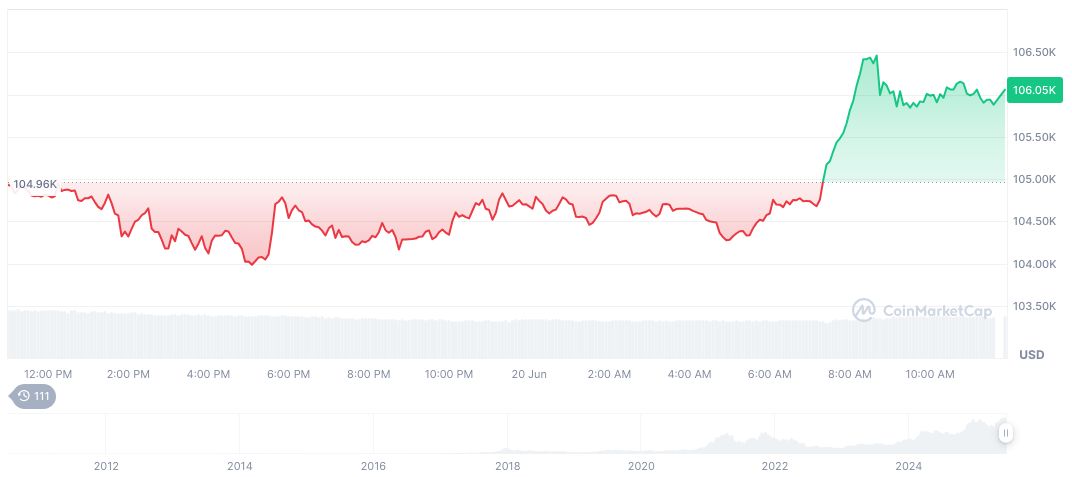

According to CoinMarketCap, Bitcoin (BTC) is currently valued at $103,493.38 with a market cap of $2.06 trillion. Its 24-hour trading volume reached $50.18 billion, marking a 32.01% change. Despite recent price dips, Bitcoin has experienced an 18.72% rise over the last 60 days, showing enduring volatility among digital currencies.

The Coincu research team highlights the potential for substantial regulatory advancement as Thailand refines its digital asset framework. The proposed legislation reflects the nation’s efforts to balance innovation with protection against fraudulent activities, which may foster a more robust environment for crypto investments in the region.