AI chip stocks are experiencing unprecedented demand right now as investors seek the next Nvidia-style breakthrough, and also, according to 24/7 Wall St’s latest research, three specific AI chip stocks – Broadcom, ASML, and Palantir – represent the best AI stocks 2025 for explosive growth potential. These Nvidia alternatives offer investors strategic ways to manage market volatility while capturing AI semiconductor gains.

Also Read: DeepSeek’s Rise: How China’s $236B Influx Could Crush NVIDIA (NVDA) AI Stocks

Top AI Semiconductor Picks And Strategies To Manage Market Volatility

The AI chip stocks revolution centers on three companies positioned for massive returns right now. Each represents different AI semiconductor picks with unique advantages in the expanding artificial intelligence market, and also provides various ways to manage market volatility.

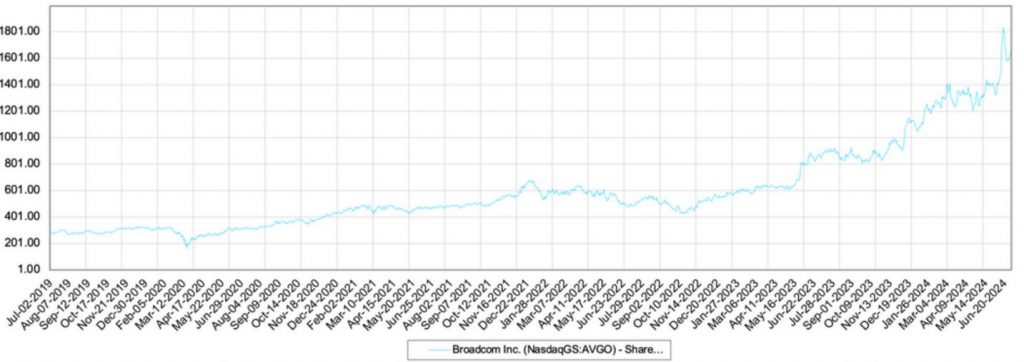

1. Broadcom – NVIDIA’s Primary Rival

Broadcom leads the race among AI chip stocks as tech giants build custom processors, and right now, Google’s recent breakthrough proves the company’s potential among Nvidia alternatives.

Broadcom stated at their recent AI Investor Day:

“If we go back to 2 years ago, a cluster that was state-of-the-art at the time had 4,096 XPUs (processors like Broadcom builds)… Now as you go towards 2024, we are going to extend this to over 30,000 and the objective of many of these consumer AI customers is how do we take this to 1 million.”

The company’s networking revenue also benefits from AI infrastructure growth, making it one of the most balanced AI semiconductor picks at the time of writing.

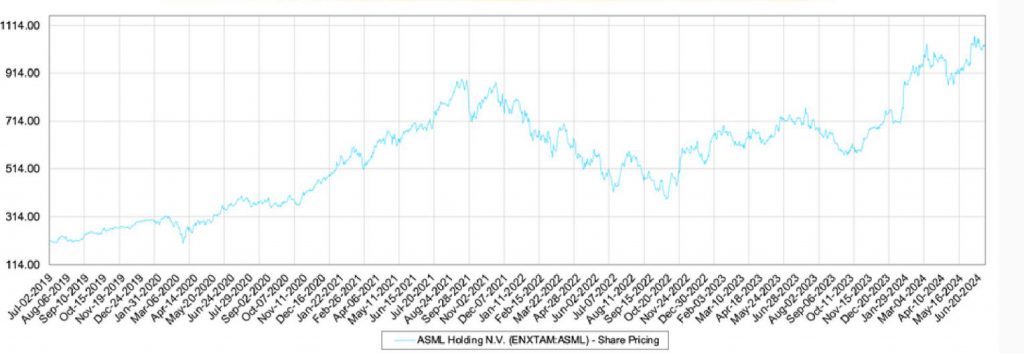

2. ASML – The Technology Monopoly

ASML represents the safest AI chip stocks investment with its complete monopoly on advanced chip manufacturing equipment, and also, the Dutch company’s machines are essential for producing cutting-edge AI processors.

Every major AI semiconductor manufacturer requires ASML’s extreme ultraviolet lithography machines, creating an unbreakable competitive moat among AI chip stocks right now.

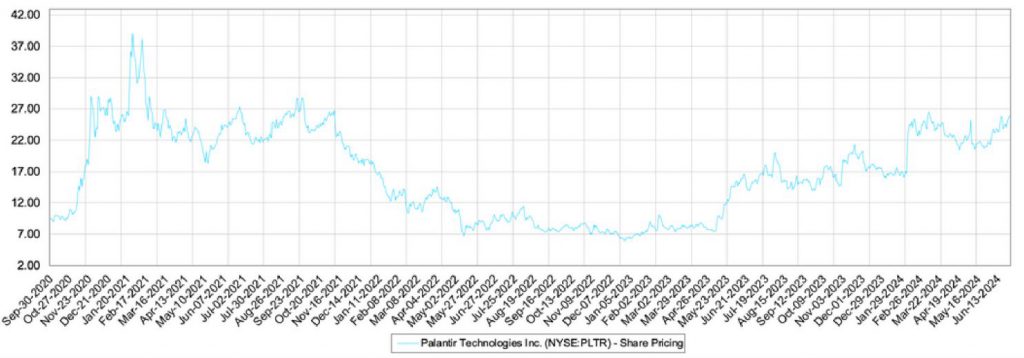

3. Palantir – The Enterprise AI Platform

Palantir offers the highest growth potential among these AI semiconductor picks through its Artificial Intelligence Platform targeting enterprise customers, and also has been gaining momentum recently.

Palantir’s CEO stated:

“The demand for AIP (Artificial Intelligence Platform) is unlike anything we have seen in the past 20 years. We are currently in discussions with more than 300 additional enterprises to deploy AIP within their organizations, all of which are searching for an effective and secure means of adapting the latest large language models for use on their internal systems and proprietary data.”

Strategic Investment Approach

These AI chip stocks provide diversified exposure to manage market volatility effectively right now, and also, ASML offers defensive characteristics while Broadcom provides balanced growth. Palantir delivers high-growth potential among the best AI stocks 2025.

Institutional investors are positioning across these Nvidia alternatives to capture different aspects of AI growth while managing risk through diversification strategies at the time of writing.

Also Read: Top Three AI Stocks To Buy Now to Rival Nvidia (NVDA)