In June, Fireblocks released the “State of Stablecoins 2025” report, highlighting significant adoption of stablecoins among institutions for payments worldwide.

The report indicates regulatory clarity and robust infrastructure as drivers for this shift, with major implications for cryptocurrencies supporting stablecoins.

49% of Institutions Now Embrace Stablecoins for Payments

Fireblocks’ report highlights growing adoption, revealing that 49% of institutions surveyed are already using stablecoins. Another 41% are in the pilot stage or planning implementation. This shift reflects improved regulatory environments and the robustness of compliance tools now available.

The infrastructure has strengthened significantly. With 86% of respondents confident in handling stablecoin transactions, the market is witnessing an infusion of liquidity. Industry leaders like Zeebu have processed transactions worth $5.70 billion, signaling real-world applications.

Market reactions have been positive, with financial sectors preparing for increased stablecoin usage. No specific statements from Fireblocks executives were noted, but industry insiders are optimistic about scalable stablecoin-based operations.

Regulatory Clarity Drives Institutional Stablecoin Surge

Did you know? Stablecoins, once seen as niche, are now central to global institutions’ payment strategies, thanks to diminished regulatory hurdles. Just two years ago, 80% cited compliance as a barrier.

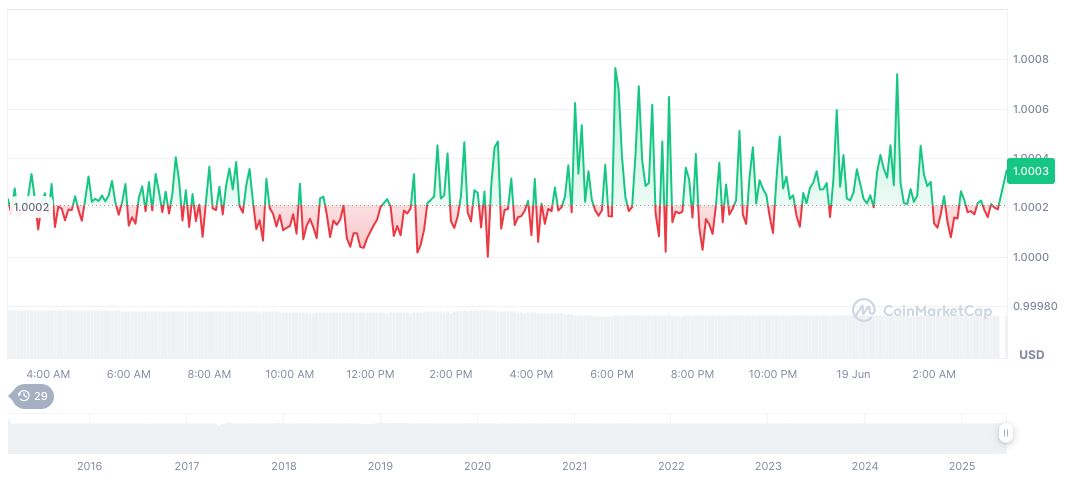

According to CoinMarketCap, the circulating supply for Tether USDt (USDT) remains stable at 155,719,756,689. Its market cap stands at 155,743,884,775, with a 4.80% dominance. The trading volume over the last 24 hours reached 57,559,461,080, showing a -21.99% change.

Insights from the Coincu research team highlight ongoing adaptation in financial sectors. Technological upgrades and strengthened compliance environments are paving the way for broader institutional adoption of stablecoins, reinforcing trust and transparency in the crypto sphere.