GENIUS Act stablecoin regulation passed the U.S. Senate, creating the first comprehensive regulatory framework for stablecoins in America. Guillaume Poncin, CTO of Alchemy, predicts that with GENIUS Act stablecoin regulation in place, every bank will issue its own stablecoin and operate blockchain infrastructure. The stablecoin regulation senate vote enables bank-issued stablecoin adoption across traditional financial institutions.

Also Read: Senate Passes GENIUS Act as JPMorgan Meets SEC on Onchain Markets

Bank‑Issued Stablecoin Trends & Blockchain Adoption Post‑Genius Act

Until now, major banks held back from entering the stablecoin market, waiting for clear GENIUS Act stablecoin regulation that the new bill addresses. Alchemy CTO insight reveals significant revenue opportunities for financial institutions entering this space.

Poncin stated:

“For banks, issuing their own stablecoins allows them to capture the float on reserves, with the ability to bring in hundreds of millions in annual revenue from treasury yields at current rates. They also maintain control over their customer relationships and transaction flows rather than ceding that to third-party issuers.”

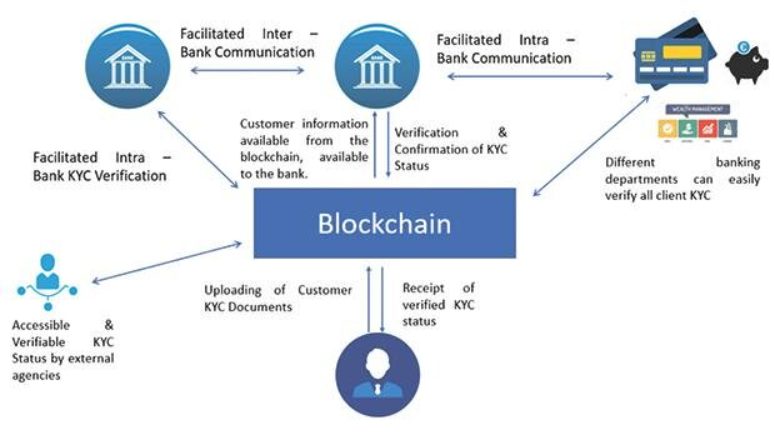

The stablecoin regulation senate framework enables banks to offer clients instant settlement, 24/7 availability, and programmable money backed by traditional banking trust. Bank blockchain adoption will accelerate as institutions recognize these competitive advantages.

Market Competition and Infrastructure Choices

Existing stablecoin issuers like Circle and Tether won’t be displaced by bank-issued stablecoin competition, according to Alchemy CTO insight. Different market segments will emerge for specialized players.

Poncin explained:

“Circle and Tether have established themselves as the default rails for crypto-native use cases and international transfers. Banks can focus on different segments, like corporate treasury, regulated institutional flows, and integration with existing banking services.”

Bank blockchain adoption will favor layer-2 networks for retail applications due to cost efficiency, while layer-1 networks suit large-scale B2B transactions requiring maximum security.

Also Read: Central Banks to Accumulate More Gold in Reserves, Cut Down on USD

The GENIUS Act stablecoin regulation creates unprecedented opportunities for traditional finance to integrate blockchain technology seamlessly. With regulatory clarity clearily established right now, banks are ready to start their shifting from asking “if” to “how fast can we move” regarding stablecoin implementation.