Ethereum’s BlackRock developments show massive institutional confidence as the world’s largest asset manager purchased an additional $500 million in Ethereum during an 8% price correction. BlackRock’s strategic accumulation of cryptocurrency positions demonstrates how institutional investors are capitalizing on market volatility, and the firm added approximately 154,000 ETH to spot exchange-traded funds. This ethereum BlackRock move signals growing trust in Ethereum price prediction models among major financial institutions, and also highlights the increasing appetite for digital assets among traditional money managers.

Also Read: Bitcoin ETF Flows: Institutional Money Keeps Pouring In

Ethereum’s BlackRock Deal Signals Rising Institutional Crypto Trust

The ethereum BlackRock investment strategy reflects calculated positioning amid cryptocurrency market turbulence, and at the time of writing, BlackRock executives view this accumulation as leveraging short-term weakness for long-term gains. This is particularly notable as Ethereum approached critical support levels near $2,200, and also because many retail investors were experiencing anxiety during the same period.

Larry Fink, CEO of BlackRock, stated:

“Ethereum’s role as an institutional-grade financial infrastructure is becoming increasingly clear, and we’re seeing growing client demand for tokenized assets.”

Strategic Accumulation During Market Correction

BlackRock’s ethereum BlackRock approach demonstrates sophisticated timing as institutional investors recognize Ethereum’s resilience and potential. The cryptocurrency experienced notable volatility, yet major players like BlackRock increased their positions rather than retreating, and this pattern suggests institutional investors view current prices as attractive entry points right now.

The $500 million injection represents more than just portfolio diversification—it signals confidence in Ethereum’s technological roadmap and its role in decentralized finance ecosystems. BlackRock’s pivot toward Ethereum ETFs further establishes the cryptocurrency as a critical component of institutional portfolios, and also demonstrates how traditional finance is embracing digital assets such as Ethereum and bitcoin.

Market Implications and Technical Analysis

Ethereum BlackRock movements coincide with the cryptocurrency approaching historic support zones, and this $2,200 level has historically provided a price floor during market corrections. Institutional investors appear to be timing their entries around these technical indicators, and also seem to be following a playbook that has worked well in previous cycles.

The strategic purchasing behaviour in this correction reflects prior markets cycles of Ethereum, in that institutional buying is characteristically followed by price patching and possible bullish movement. The further funding by BlackRock further demonstrates the idea that Ethereum will remain the foundation of the new financial infrastructure, and by the time of the writing, other institutional investors move in a similar way.

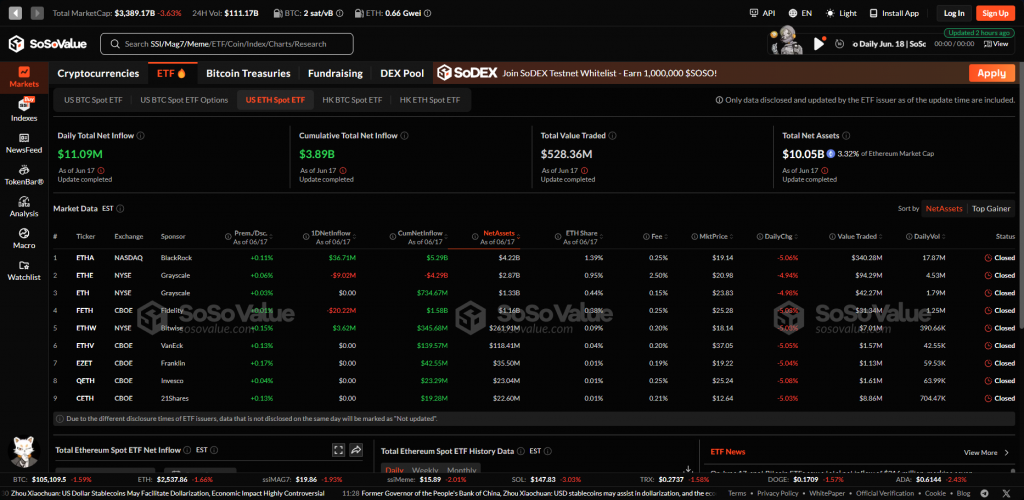

According to market analysts, inflows of up to 154,000 ETH into the spot ETFs mean that there is deliberate accumulation of large players like BlackRock among others institutional investors. The trend indicates increasing acknowledgement of Ethereum as a platform underlying tokenized asset systems and uncentralized applications as well as demonstrating that cryptocurrencies will increasingly become massified in the world of conventional finance enterprises.

Also Read: Ethereum Price Prediction: What $2,500 Support Means for Bulls

Conclusion

The Ethereum BlackRock plan is also symptomatic of more general institutional awareness of cryptocurrency as a legitimate investment category, and even with the uncertainty surrounding its regulatory status and various technical issues, large financial institutions are increasing their digital asset participation. Even the active reaction to market volatility proves the culture of institutional wisdom in the cryptocurrency markets, and the other fund investment of $500 million in The firm portrays further certainty in the Ethereum scenario of price forecasts, which hangs more about the development of markets over time.

At this moment, such an Ethereum BlackRock positioning demonstrates both how institutional investors index substantial cryptocurrency structures in such a market downtrend, and it also points to the fact that they are considering current prices to be attractive in terms of accumulation strategies.