The question of de-dollarization and how far it can go becomes increasingly relevant as major economies embrace local currencies for international trade guided by BRICS. Our global de-dollarization tracker reveals that over 90 nations are abandoning US dollar and conducting transactions in yuan, rupee, and ruble instead of dollars, and this marks a fundamental change in the international monetary system that has dominated for decades.

The following comprehensive tracker shows which countries are leading this transformation and at what stage of implementation they currently stand:

Also Read: De-Dollarization: Full List of Countries Dropping the US Dollar & Key Reasons

Global De-Dollarization Tracker: BRICS Shift And Future Impacts

US Dollar’s Declining Share Accelerates Right Now

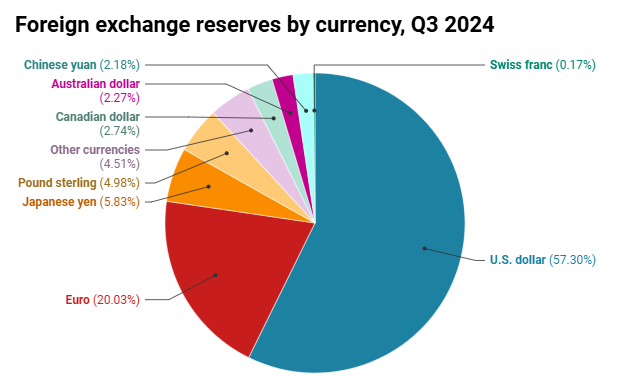

When we examine BRICS de-dollarization trend and how far it can go, the numbers tell an interesting story. The USD’s share of global foreign exchange reserves has been declining from over 70% in 2000 to 57.8% in 2024, and this trend shows no signs of slowing down. Asia leads this charge, with ASEAN committing to local currency use in trade as part of its Economic Community Strategic Plan for 2026 to 2030.

Francesco Pesole, FX strategist at ING, was clear about the fact that:

“Trump’s erratic trade policy decisions and the dollar’s sharp depreciation are probably encouraging a more rapid shift towards other currencies.”

Bank of America warns of a severe US dollar decline this summer and projects that de-dollarization in ASEAN will pick up pace through conversion of FX deposits accumulated since 2022. The global de-dollarization tracker shows this momentum is building across multiple regions.

BRICS Payment Systems Transform Trade

The question of BRICS de-dollarization and how far it can go becomes clearer when examining Russia-China bilateral trade patterns. USD usage dropped dramatically from 90% in 2015 to just around 10% by 2024, and the two countries now conduct their $243 billion trade volume primarily in rubles and yuan.

Russian President Vladimir Putin had this to say:

“The dollar is being used as a weapon. We really see that this is so. I think that this is a big mistake by those who do this.”

India has also established Special Rupee Vostro Accounts with 123 correspondent banks from 30 countries, allowing trade settlements in local currencies and supporting the global de-dollarization tracker momentum that’s gaining traction worldwide. While Asian nations lead in implementation, the African continent represents the fastest-growing segment of the de-dollarization movement, with numerous countries at various stages of adopting alternative currency systems.

Political Pressures Shape De-Dollarization Progress

At the time of writing, President Trump has threatened tariffs of 100-150% on BRICS nations pursuing de-dollarization, and this creates significant political pressure.

Brazilian President Lula da Silva stated:

“BRICS+ is committed to ending US dollar dominance no matter what.”

Brazilian President Luiz Inácio Lula da Silva initially supported a common currency but later adjusted Brazil’s approach after these threats. Beyond traditional currency alternatives, many nations are also developing Central Bank Digital Currencies (CBDCs) as a technological pathway to reduce dollar dependency and enhance monetary sovereignty.

Tracking Real Numbers Across 90+ Nations

The global de-dollarization tracker shows over 90 nations actively using alternative currencies, and the Commonwealth of Independent States achieves 85% of cross-border transactions in national currencies instead of dollars. This massive shift has transformed how nations conduct international trade.

Former Congressman Ron Paul predicted what he calls the “Rio Reset” for July 2025, warning:

“The BRICS alliance is preparing their ‘Rio Reset’ this July – exactly the challenge to dollar hegemony I’ve been predicting.”

BRICS Pay development accelerates as the New Development Bank provides $100 billion in financing capabilities for infrastructure projects in local currencies, and this institutional support helps answer questions about BRICS de-dollarization and how far it can go.

BRICS Currency Shift: Future Outlook & Challenges Ahead

The diversity within BRICS also creates implementation hurdles, as members range from anti-Western countries to neutral players with different priorities. However, with BRICS+ representing 46% of global GDP and 55% of world population, the bloc has substantial economic weight that cannot be ignored.

Also Read: BRICS Will Meet in July To Unveil Most Ambitious Plan: US Congressman

The global de-dollarization tracker shows that more nations are seeking financial sovereignty and reducing their exposure to US economic policies, which continues to erode dollar dominance.

When considering BRICS de-dollarization and how far can it go, the evidence points to a monetary system in transition, with local currencies gaining ground against decades of dollar dominance. While complete displacement remains unlikely in the short term, momentum suggests continued progress toward a more multipolar currency system that could reshape global finance.