On June 13, 2025, during a UN Security Council emergency meeting, Iran and Israel exchanged serious allegations over military actions involving nuclear sites in Iran.

Israel’s defense against Iran developing nuclear weapons reflects ongoing regional struggles, affecting diplomatic and security dynamics globally. Market participants keenly observe, aware of potential crypto volatility due to unresolved issues between the two nations.

Israel and Iran Accusations Intensify Amidst Nuclear Dispute

Iran’s UN representative, Saeed Iravani, criticized Israeli military actions as state terrorism, accusing breakthroughs in nuclear diplomacy. According to Iravani, “Israeli strikes are a serious violation of international law and an act of state terrorism.”

In contrast, Israel’s Danny Danon justified strikes as necessary to prevent nuclear weapon development, citing international failure to restrict Iran’s ambitions. Meanwhile, the U.S. denied involvement, urging Iran towards diplomacy.

Immediate effects involve increased market focus on cryptocurrencies such as BTC and ETH. Historically, geopolitical tensions involving nuclear questions lead to heightened market responses. Investors often look to digital assets amid global uncertainties.

Crypto Market Reacts to Crisis; Bitcoin Stability in Focus

Did you know? During past UN Security Council sessions, regional tensions have historically led to quick yet temporary spikes in crypto asset prices as market participants react defensively to unstable geopolitical environments.

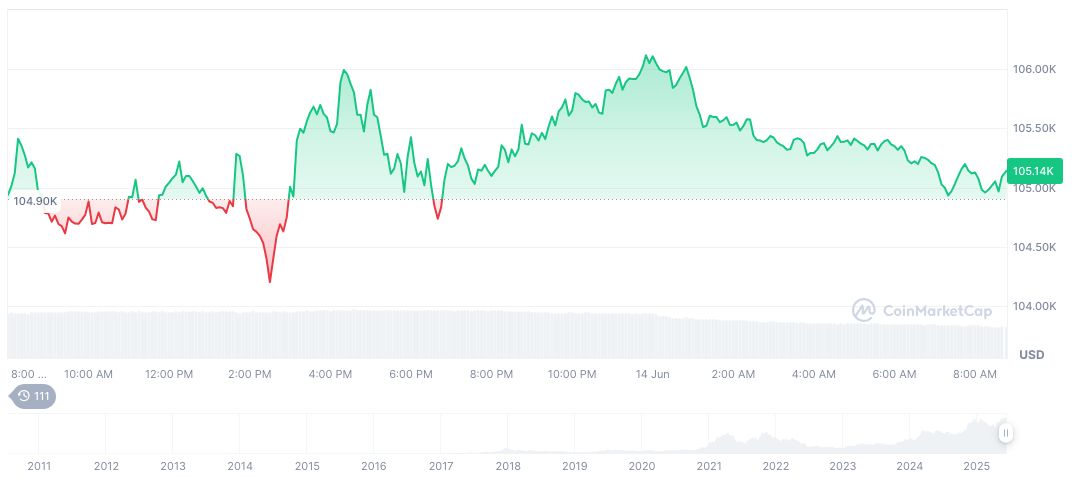

As reported by CoinMarketCap on June 14, 2025, Bitcoin (BTC) traded at $105,017.32, reflecting a market cap nearing $2.09 trillion. Despite a recent decline of 0.11%, BTC showed a robust 60-day increase of 24.94%, suggesting resilience amid uncertainty. With a circulating supply of 19.878 million out of 21 million, BTC maintains a 64% market dominance.

According to Coincu research team, crypto may experience short-term volatility with renewed tensions. Emergency meetings often amplify asset shifts, but long-term impacts depend on diplomatic resolutions and geopolitical stability. While regulatory landscapes remain inert, market players eye BTC’s historical stability as a potential hedge amid prevailing uncertainties.