XRP bank partnerships now cover more than 140 financial institutions around the world, and right now, that list is still growing. From Banco Santander and HSBC to JP Morgan and Deutsche Bank, the scale of XRP bank adoption was pretty hard to picture just a few years ago. Ripple’s Deutsche Bank deal, confirmed in February 2026, is being seen as a real turning point — and a lot of analysts believe XRP will explode as institutional infrastructure keeps building quietly underneath the market.

Also Read: XRP Is A Done Deal, Wall Street Says, Despite Sharp Sell-Off

XRP Bank Partnerships Expand Ripple Adoption And Set XRP For Growth

What the Ripple Deutsche Bank Integration Actually Changes

XRP bank partnerships got a major boost when Deutsche Bank. A $69 billion institution, confirmed it is embedding Ripple’s payment infrastructure across cross-border settlements, FX operations, and digital asset custody. Ripple and Deutsche Bank have been building toward this since 2023. At the time of writing, the focus is on Ripple’s software stack rather than direct XRP holdings. Settlement times are expected to drop from days to seconds, and operational costs could fall by up to 30%, based on industry estimates being reported.

Deutsche Bank Executive Ciaran Byrne stated:

“A future using multiple rails — SWIFT, stablecoins, and blockchain solutions — with routing that improves efficiency, cost, and client experience.”

Community developer Bird (@Bird_XRPL) also weighed in on February 19, 2026:

“Massive news. Deutsche Bank has announced today it will work with Ripple to implement XRP powered infrastructure into its cross-border payments. The banks are coming, and the NDAs are clearly starting to lift.”

The XRP Partnerships List and the Price Disconnect

The XRP partnerships list also includes SBI Holdings, Standard Chartered, Barclays, UBS, Scotiabank, Westpac, and dozens of regional Japanese banks. DXC Technology is another name being added to the wider picture of XRP bank adoption. The company is working to embed XRP directly into the Hogan core banking platform, which manages over $5 trillion in deposits. On-Demand Liquidity usage and the upcoming RLUSD stablecoin launch are both expected to add more names to the XRP bank partnerships network in 2026.

Also Read: Why $2,000 in Ripple (XRP) Today Could Outperform Bigger Bets

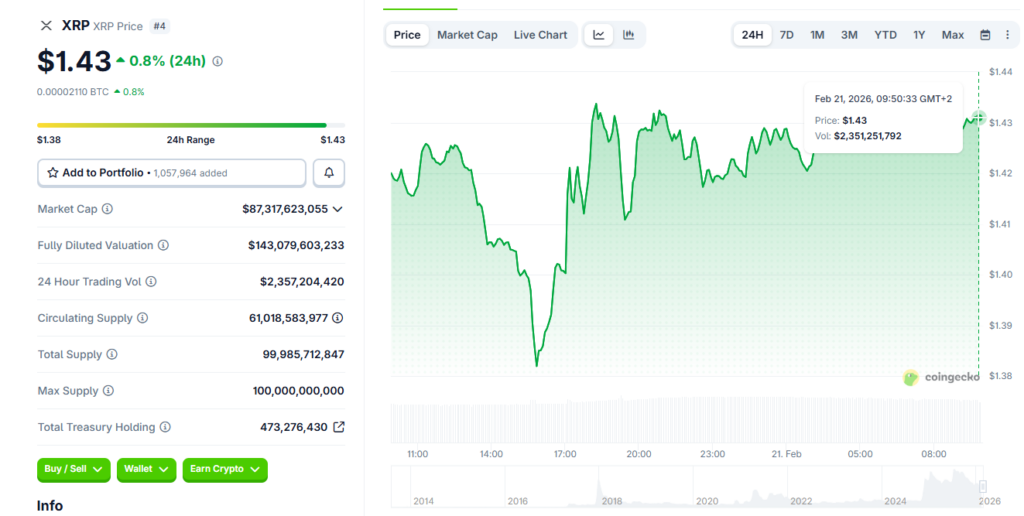

Price, right now, is not reflecting any of this. XRP is trading around $1.43, down roughly 60% from its 2025 high.

Standard Chartered revised its end-2026 target from $8 to $2.80. It’s citing short-term liquidity pressure, though its 2030 forecast stays at $28. With the XRP partnerships list still expanding and XRP bank adoption being built out at this pace, a lot of people are starting to think XRP will explode the moment macro pressure eases and the market catches up to what’s already been put in place.